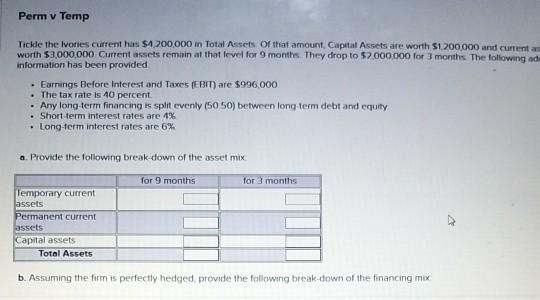

Question: Perm Temp Tickle the Ivories current has $1.200.000 in Total Assets Of that amount Capital Assets are worth $1.200.000 and current as worth $3,000,000 Current

Perm Temp Tickle the Ivories current has $1.200.000 in Total Assets Of that amount Capital Assets are worth $1.200.000 and current as worth $3,000,000 Current assets remain at that level for 9 months. They drop to $2.000.000 for 3 months The following ad information has been provided Earnings Before Interest and Taxes (EBIT) are $996.000 The tax rate is 10 percent Any long term financing is split evenly (5050) between long term debt and equity Short term interest rates are 4% Long-term interest rates are 6% a. Provide the following break down of the asset mix for 9 months for 3 months Temporary current assets Permanent current assets Capital assets Total Assets b. Assuming the firm is perfectly hedged provide the following break down of the financing mix

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts