Question: QUESTION 3 3a. Castillo Corporation has maintained a periodic inventory system and used the LIFO cost flow alternative for years. The earliest layers of LIFO

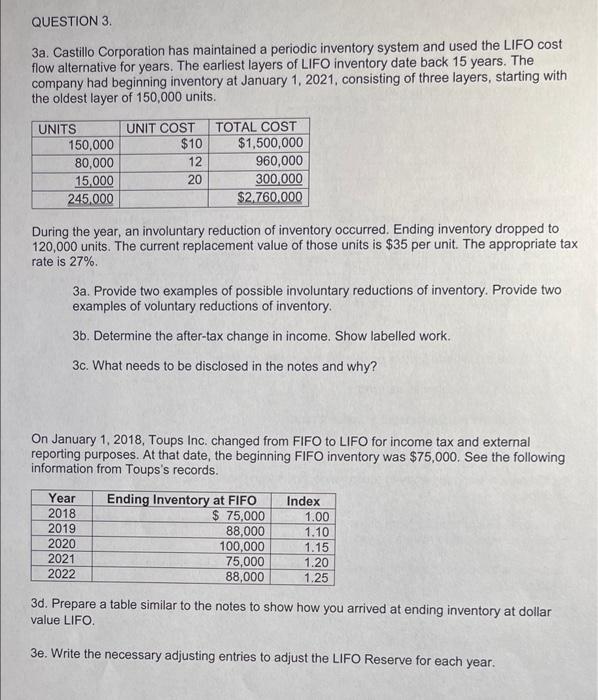

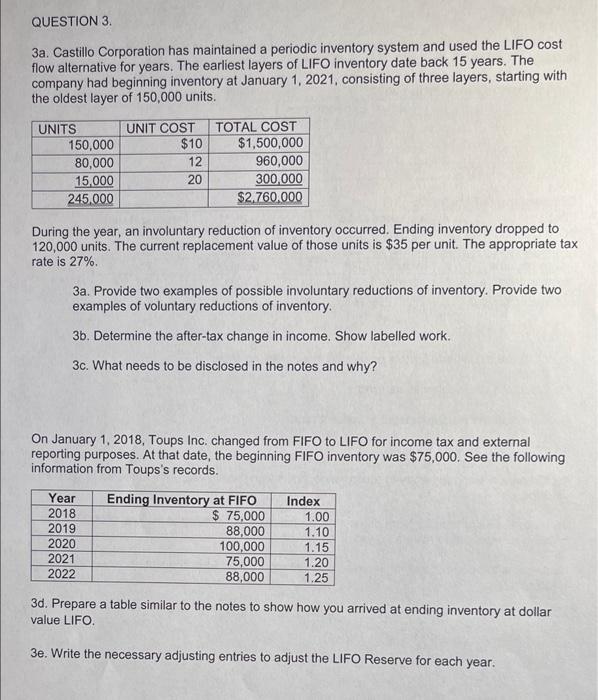

QUESTION 3 3a. Castillo Corporation has maintained a periodic inventory system and used the LIFO cost flow alternative for years. The earliest layers of LIFO inventory date back 15 years. The company had beginning inventory at January 1, 2021, consisting of three layers, starting with the oldest layer of 150,000 units. UNITS 150,000 80,000 15.000 245.000 UNIT COST $10 12 20 TOTAL COST $1,500,000 960,000 300,000 $2.760.000 During the year, an involuntary reduction of inventory occurred. Ending inventory dropped to 120,000 units. The current replacement value of those units is $35 per unit. The appropriate tax rate is 27% 3a. Provide two examples of possible involuntary reductions of inventory. Provide two examples of voluntary reductions of inventory. 3b. Determine the after-tax change in income. Show labelled work. 3c. What needs to be disclosed in the notes and why? On January 1, 2018, Toups Inc. changed from FIFO to LIFO for income tax and external reporting purposes. At that date, the beginning FIFO inventory was $75,000. See the following information from Toups's records. Year 2018 2019 2020 2021 2022 Ending Inventory at FIFO $ 75,000 88,000 100,000 75,000 88,000 Index 1.00 1.10 1.15 1.20 1.25 3d. Prepare a table similar to the notes to show how you arrived at ending inventory at dollar value LIFO. 3e. Write the necessary adjusting entries to adjust the LIFO Reserve for each year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts