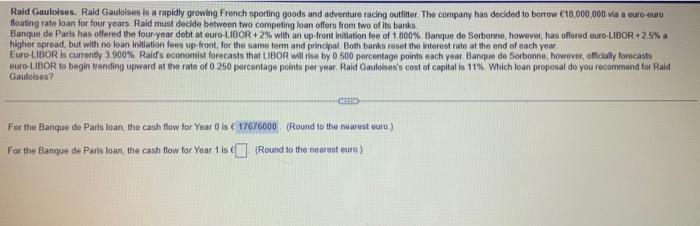

Question: Raid Gauloises. Raid Gauloises is a rapidty growing French sporting goods and atventure racing outfitter. The company has decided to berrow et8, o00,000 via a

Raid Gauloises. Raid Gauloises is a rapidty growing French sporting goods and atventure racing outfitter. The company has decided to berrow et8, o00,000 via a euse-eure flaaking rate loan for four years. Raid must decide between two competing loan offers from two of its banks. higher spread. but with no loan initiation fees up-tront, for the same term and principul. Both banks reset the interest rate at the end of each year Eure-LibOR is currenty 3.900%. Raid's econoentst forecasis that LiHOR will itue by 0500 percentage points each year Banque de Gorbonne, however, aificlally forecasts euro-tiBOR to begin trending upward at the rate of 0.250 percontage points per year. Raid Caulohas's cost of capital is 11%. Which loan proposal do you recoinmend for Raid Gaulabes? For the Banque de Paris loan, the cash flow for Year 0 is t (Round to the naarest ouro.) For the Banqua de Pearis loan, the cash flow for Year 1 is i (Round to the nearest euto)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts