Question: True False 1) TF Dividends declared are deducted as an expense in arriving at net income for a period. 2) TF The issue of capital

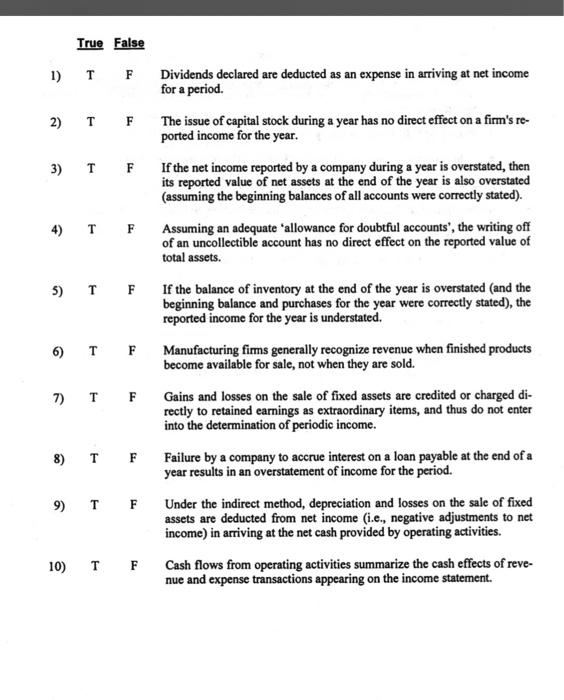

True False 1) TF Dividends declared are deducted as an expense in arriving at net income for a period. 2) TF The issue of capital stock during a year has no direct effect on a firm's re- ported income for the year. 3) TF If the net income reported by a company during a year is overstated, then its reported value of net assets at the end of the year is also overstated (assuming the beginning balances of all accounts were correctly stated). 4) T F Assuming an adequate "allowance for doubtful accounts', the writing off of an uncollectible account has no direct effect on the reported value of total assets. 5) T F If the balance of inventory at the end of the year is overstated (and the beginning balance and purchases for the year were correctly stated), the reported income for the year is understated. 6) T F Manufacturing firms generally recognize revenue when finished products become available for sale, not when they are sold. 7) TF Gains and losses on the sale of fixed assets are credited or charged di- rectly to retained earnings as extraordinary items, and thus do not enter into the determination of periodic income. 8) TF Failure by a company to accrue interest on a loan payable at the end of a year results in an overstatement of income for the period. 9) T F Under the indirect method, depreciation and losses on the sale of fixed assets are deducted from net income (i.e., negative adjustments to net income) in arriving at the net cash provided by operating activities. 10) TF Cash flows from operating activities summarize the cash effects of reve- nue and expense transactions appearing on the income statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts