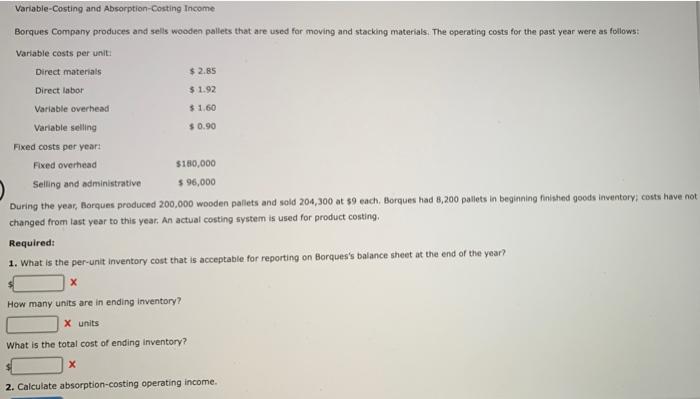

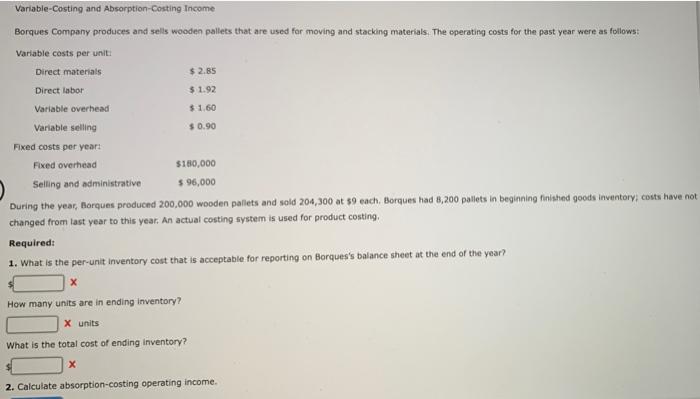

Question: Variable-Costing and Absorption-Costing Income $ 0.90 Borques Company produces and sells wooden pallets that are used for moving and stacking materials. The operating costs for

Variable-Costing and Absorption-Costing Income $ 0.90 Borques Company produces and sells wooden pallets that are used for moving and stacking materials. The operating costs for the past year were as follows: Variable costs per unit Direct materials $ 2.85 Direct labor $1.92 Variable overhead $1.60 Variable selling Fixed costs per year: Fixed overhead $160,000 Selling and administrative $ 96,000 During the year, Horques produced 200,000 wooden pallets and sold 204,300 at 39 each. Borques had 8, 200 pallets in beginning finished goods inventory, costs have not changed from last year to this year. An actual costing system is used for product costing, Required: 1. What is the per-unit Inventory cost that is acceptable for reporting on Borques's balance sheet at the end of the year? x How many units are in ending Inventory? X units What is the total cost of ending inventory? ? 2. Calculate absorption-costing operating income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts