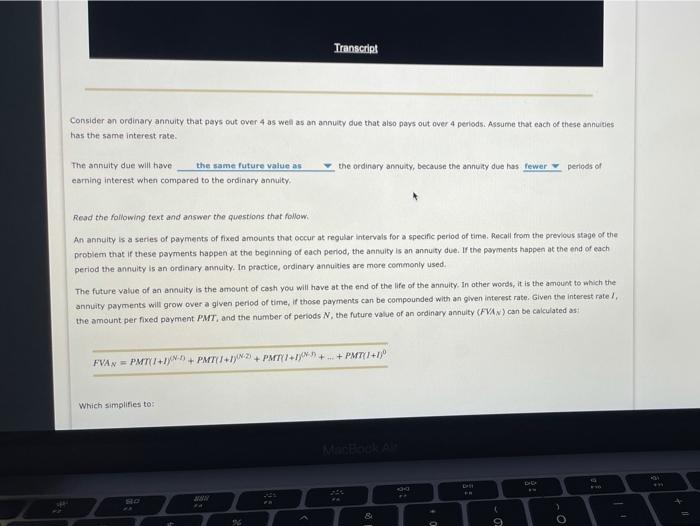

Question: Transcript Consider an ordinary annuity that pays out over 4 as well as an annuity due that also pays out over 4 periods. Assume that

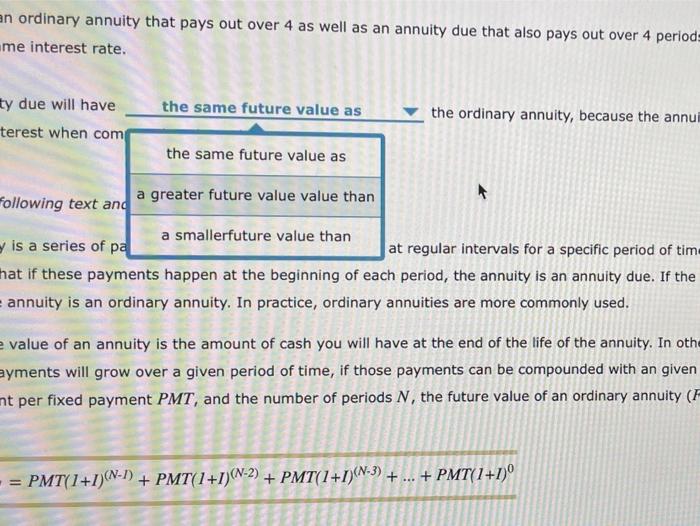

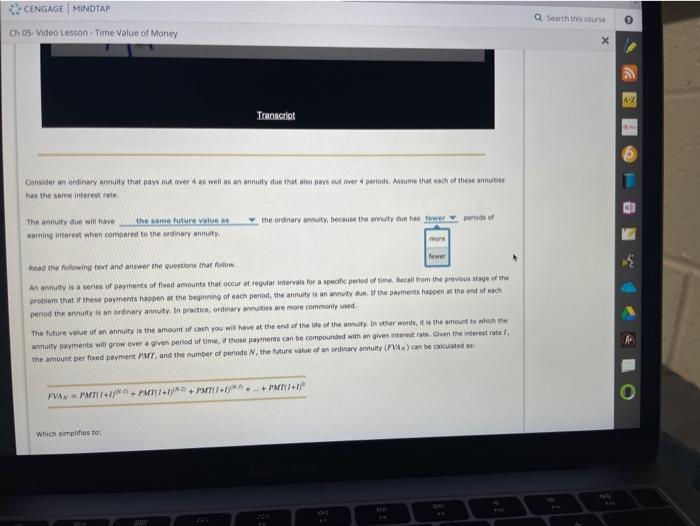

Transcript Consider an ordinary annuity that pays out over 4 as well as an annuity due that also pays out over 4 periods. Assume that each of these annuities has the same interest rate the ordinary annuity, because the annuity due has fewer periods of The annuity due will have the same future value as ebrning interest when compared to the ordinary annuity Read the following text and answer the questions that follow An annuity is a series of payments of fixed amounts that occur at regular intervals for a specific period of time, Recall from the previous stage of the problem that if these payments happen at the beginning of each period, the annuity is an annuity due. If the payments happen at the end of each period the annuity is an ordinary annuity. In practice, ordinary annuities are more commonly used The future value of an annuity is the amount of cash you will have at the end of the life of the annuity. In other words, it is the amount to which the annuity payments will grow over a given period of time, if those payments can be compounded with an given interest rate. Given the interest rate, the amount per fixed payment PMT, and the number of periods N, the future value of an ordinary annuity (FVAN) can be calculated as FVAN = PMT11+)/1+ PMT+7):2) + PMT+7099 + + PATY/+7) Which simplifiesto: 10 FH W 1 9 an ordinary annuity that pays out over 4 as well as an annuity due that also pays out over 4 periods me interest rate. the same future value as ty due will have terest when com the ordinary annuity, because the annu the same future value as Following text and a greater future value value than a smallerfuture value than is a series of pa at regular intervals for a specific period of tim that if these payments happen at the beginning of each period, the annuity is an annuity due. If the annuity is an ordinary annuity. In practice, ordinary annuities are more commonly used. value of an annuity is the amount of cash you will have at the end of the life of the annuity. In othe eyments will grow over a given period of time, if those payments can be compounded with an given mt per fixed payment PMT, and the number of periods N, the future value of an ordinary annuity (F = PMT(1+1)(N-1) + PMT(1+1)(N-2) + PMT(1+1)(N-3) + ... + PMT(1+1) CENGAGE MINOTAP Search this course Ch 05- Video Lesson - Time Value of Money X 2 Transcript Consider an ordinary annuity that pays out over as well as an annuity due that we wou were periode, Mume that each of the annuon has the same interest rate The annuity due will have the same future values earning interest when compared to the ordinary annuity the ordinary wty, because the amoly out new tower werd uf more Read the following text and answer the question that follow Newer An annuity is a verles of payments of fixed amounts that occur at regular intervals for a specific period of time. Recall from the previous stage of the problem that if these payments happen at the beginning of each period, the annuity is an annuity due of the paymentsen at the end of each period the annuity is an ordinary annuity. In practice, ordinary annuities are more commonly used The future value of an annuity is the amount of cash you will have at the end of the site of the annuty. In other words, it is the amount to where annuity payments will grow over a given period of time, those payments can be compounded with an given interest rate. Given the interest rate, the amount per fred payment PMT, and the number of periods , the future value of an ordinary annuity (PWA) can be calculated FVA - PMM):11 PMTI/473 + PA++// which simplifiesto

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts