Question: Travis & Sons has a capital structure that is based on 55 percent debt, 10 percent preferred stock, and 35 percent common stock. The

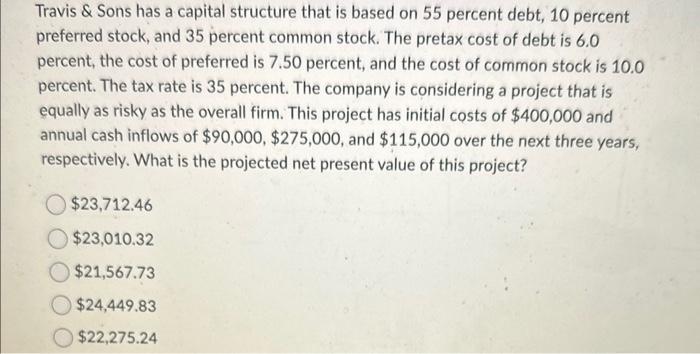

Travis & Sons has a capital structure that is based on 55 percent debt, 10 percent preferred stock, and 35 percent common stock. The pretax cost of debt is 6.0 percent, the cost of preferred is 7.50 percent, and the cost of common stock is 10.0 percent. The tax rate is 35 percent. The company is considering a project that is equally as risky as the overall firm. This project has initial costs of $400,000 and annual cash inflows of $90,000, $275,000, and $115,000 over the next three years, respectively. What is the projected net present value of this project? $23,712.46 $23,010.32 $21,567.73 $24,449.83 $22,275.24

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts