Question: tried following from another chegg post but my answers were incorrect Under its executive stock option plan, National Corporation granted 30 million options on January

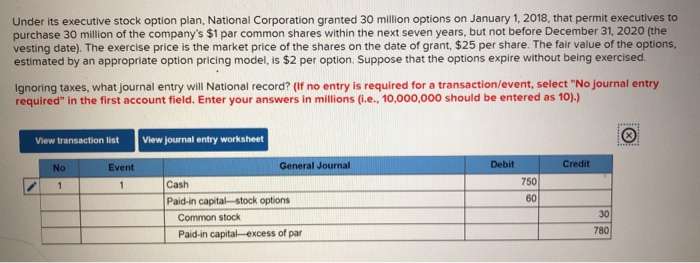

Under its executive stock option plan, National Corporation granted 30 million options on January 1, 2018, that permit executives to purchase 30 million of the company's $1 par common shares within the next seven years, but not before December 31, 2020 (the vesting date). The exercise price is the market price of the shares on the date of grant, $25 per share. The fair value of the options, estimated by an appropriate option pricing model, is $2 per option. Suppose that the options expire without being exercised. Ignoring taxes, what journal entry will National record? (If no entry is required for a transaction/event, select "No journal entry required in the first account field. Enter your answers in millions (i.e., 10,000,000 should be entered as 10).) View transaction list View journal entry worksheet No Event Debit Credit 1 750 General Journal Cash Paid-in capital stock options Common stock Paid-in capital excess of par

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts