Question

Trish (60%) and Anton (40%) are in a partnership which carries on a business. They are both 39 years old. Trish works full time

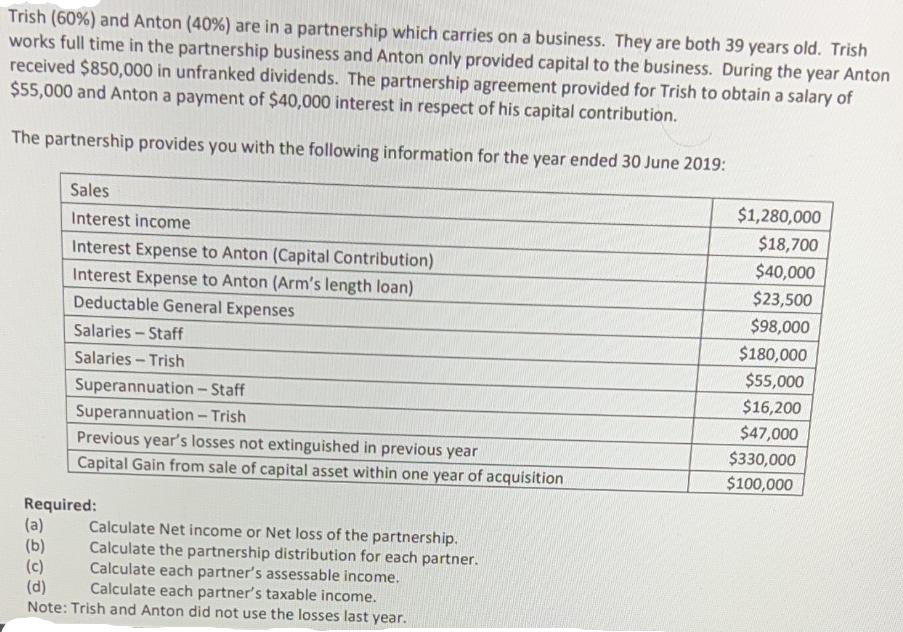

Trish (60%) and Anton (40%) are in a partnership which carries on a business. They are both 39 years old. Trish works full time in the partnership business and Anton only provided capital to the business. During the year Anton received $850,000 in unfranked dividends. The partnership agreement provided for Trish to obtain a salary of $55,000 and Anton a payment of $40,000 interest in respect of his capital contribution. The partnership provides you with the following information for the year ended 30 June 2019: Sales Interest income Interest Expense to Anton (Capital Contribution) Interest Expense to Anton (Arm's length loan) Deductable General Expenses Salaries- Staff Salaries-Trish Superannuation - Staff Superannuation - Trish Previous year's losses not extinguished in previous year Capital Gain from sale of capital asset within one year of acquisition Required: (a) (b) (c) (d) Calculate Net income or Net loss of the partnership. Calculate the partnership distribution for each partner. Calculate each partner's assessable income. Calculate each partner's taxable income. Note: Trish and Anton did not use the losses last year. $1,280,000 $18,700 $40,000 $23,500 $98,000 $180,000 $55,000 $16,200 $47,000 $330,000 $100,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Net income or Net loss of the partnership Calculating total income Sales 1280000 Interest income 1...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started