Question: tro Graphical derivation and interpreting beta You are analyzing the performance of two stocks as shown in the following graphs: The first shown in Panel

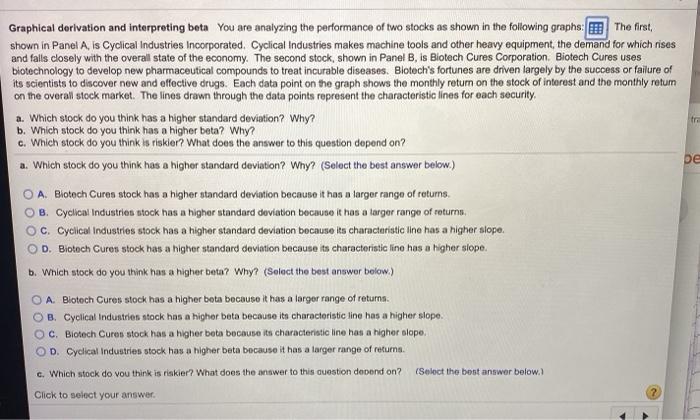

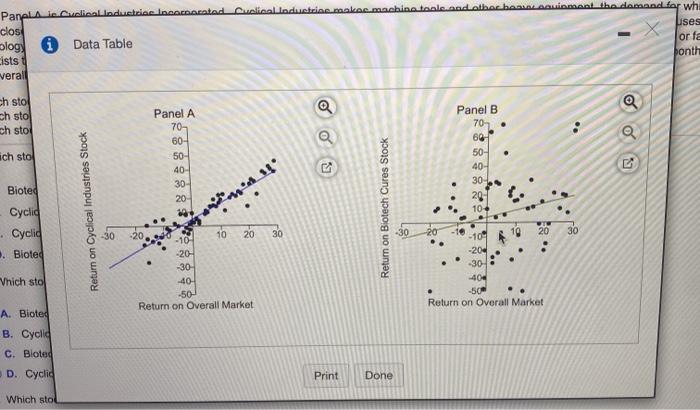

tro Graphical derivation and interpreting beta You are analyzing the performance of two stocks as shown in the following graphs: The first shown in Panel A, Is Cyclical Industries Incorporated. Cyclical Industries makes machine tools and other heavy equipment, the demand for which rises and fails closely with the overall state of the economy. The second stock, shown in Panel B, is Biotech Cures Corporation. Biotech Cures uses biotechnology to develop new pharmaceutical compounds to treat incurable diseases. Biotech's fortunes are driven largely by the success or failure of its scientists to discover new and effective drugs. Each data point on the graph shows the monthly return on the stock of interest and the monthly retum on the overall stock market. The lines drawn through the data points represent the characteristic lines for each security a. Which stock do you think has a higher standard deviation? Why? b. Which stock do you think has a higher beta? Why? c. Which stock do you think is riskler? What does the answer to this question depend on? be a. Which stock do you think has a higher standard deviation? Why? (Select the best answer below.) O A Biotech Curen stock has a higher standard deviation because it has a larger range of returns. OB. Cyclical Industries stock has a higher standard deviation because it has a larger range of returns cyclical Industries stock has a higher standard deviation because its characteristic line has a higher slope. OD. Biotech Curen stock has a higher standard deviation because its characteristic line has a higher slope. b. Wnich stock do you think has a higher beta? Why? (Select the best answer below.) O A Biotech Cures stock has a higher bota because it has a larger range of returns. OB. Cyclical Industries stock has a higher beta because its characteristic line has a higher slope. c. Biotech Cures stock has a higher beta because its characteristic line has a higher slope. OD. Cyclical Industries stock has a higher beta because it has a larger range of returns OC C. Which stock do vou think is riskier? What does the answer to this question depend on? (Select the best answer below. Click to select your answer. whi Pan clos blog) cists verall A wh Uses Data Table or fe bonth ch stol ch sto ch stol Q o ich stol Panel A 70- 60- 50 40- 30 20 2 Panel B 70 60 50- 40 30- 29 104 Return on Cyclical Industries Stock Bioted Cyclid Cyclia . Bioted mo Retum on Biotech Cures Stock 30 -30 10 20 30 -10 -20 20 10 20 -10 -20- -30 -40- -50- Return on Overall Market Vnich sto -30 -404 -50 Return on Overall Market A. Bioted B. Cyclic C. Bloted D. Cyclic Print Done Which sto c. Which stock do you think is riskier? What does the answer to this question depend on? (Select the best answer below.) A. Cyclical Industries Corporation. B. Biotech Cures Corporation Click to select your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts