Question: Tropical Candy Inc are considering two mutually-exclusive projects, A and B. Their cash flows are shown below. Both Project A and Project B have an

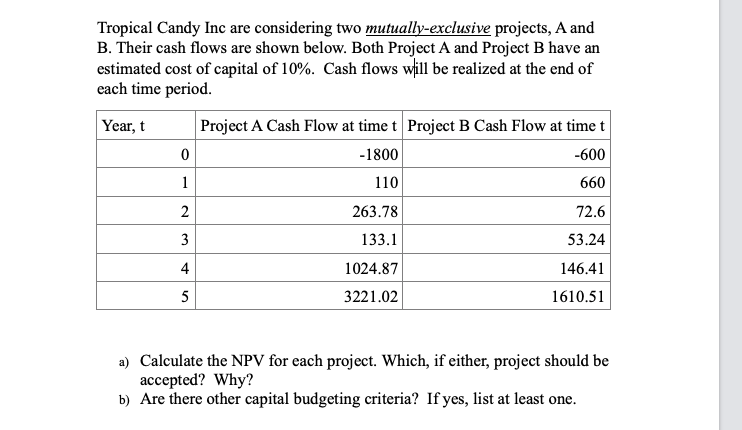

Tropical Candy Inc are considering two mutually-exclusive projects, A and B. Their cash flows are shown below. Both Project A and Project B have an estimated cost of capital of 10%. Cash flows will be realized at the end of each time period. Year, t Project A Cash Flow at time t Project B Cash Flow at time t 0 -1800 -600 1 110 660 2 263.78 72.6 133.1 53.24 4 1024.87 146.41 5 3221.02 1610.51 2 3 5 a) Calculate the NPV for each project. Which, if either, project should be accepted? Why? b) Are there other capital budgeting criteria? If yes, list at least one

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts