Question: True / false 5-7 10,11,14 5. A project should be accepted if its profitability index (PI) > 0. 0 0 6. The IRR does not

True / false

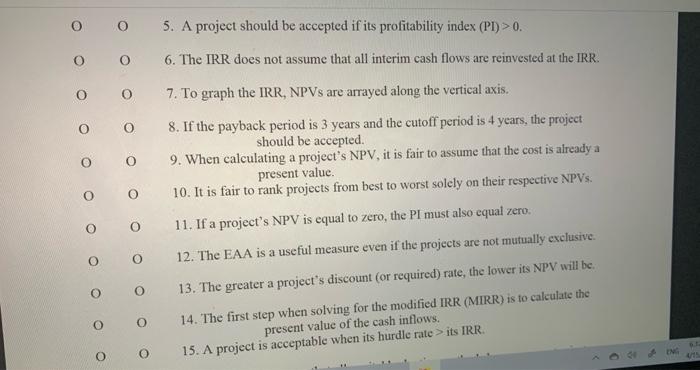

True / false 5. A project should be accepted if its profitability index (PI) > 0. 0 0 6. The IRR does not assume that all interim cash flows are reinvested at the IRR. O O O 0 O 0 O 7. To graph the IRR, NPVs are arrayed along the vertical axis. 8. If the payback period is 3 years and the cutoff period is 4 years, the project should be accepted. 9. When calculating a project's NPV, it is fair to assume that the cost is already a present value 10. It is fair to rank projects from best to worst solely on their respective NPVs. 11. If a project's NPV is equal to zero, the PI must also equal zero. 12. The EAA is a useful measure even if the projects are not mutually exclusive 13. The greater a project's discount (or required) rate, the lower its NPV will be 14. The first step when solving for the modified IRR (MIRR) is to calculate the present value of the cash inflows. 15. A project is acceptable when its hurdle rate > its IRR. O o 0 O O O 0 O O O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts