Question: True False True False 1. Decision analysis will not solve a decision problem, nor is it intended to. Its purpose is to produce insight and

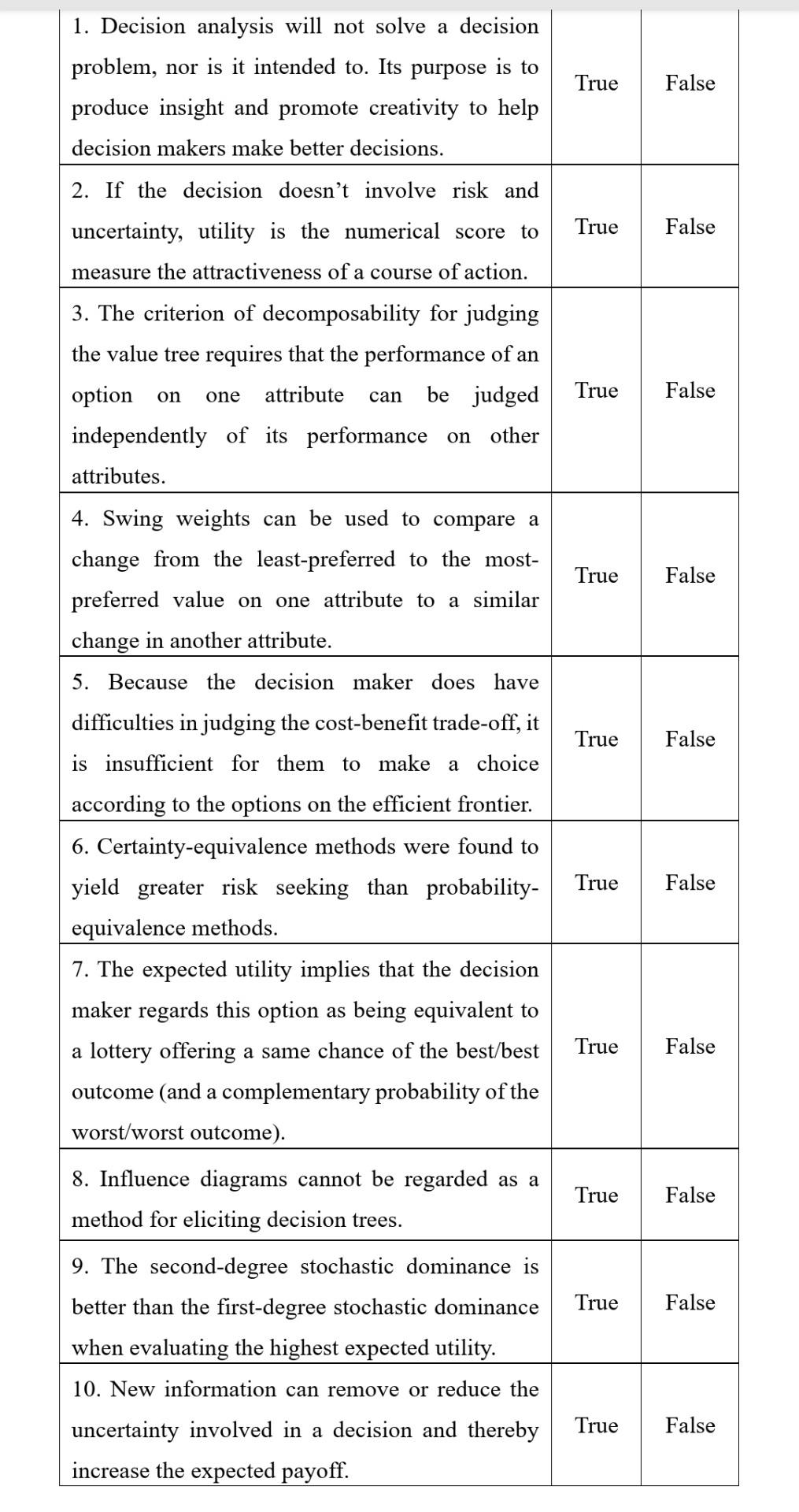

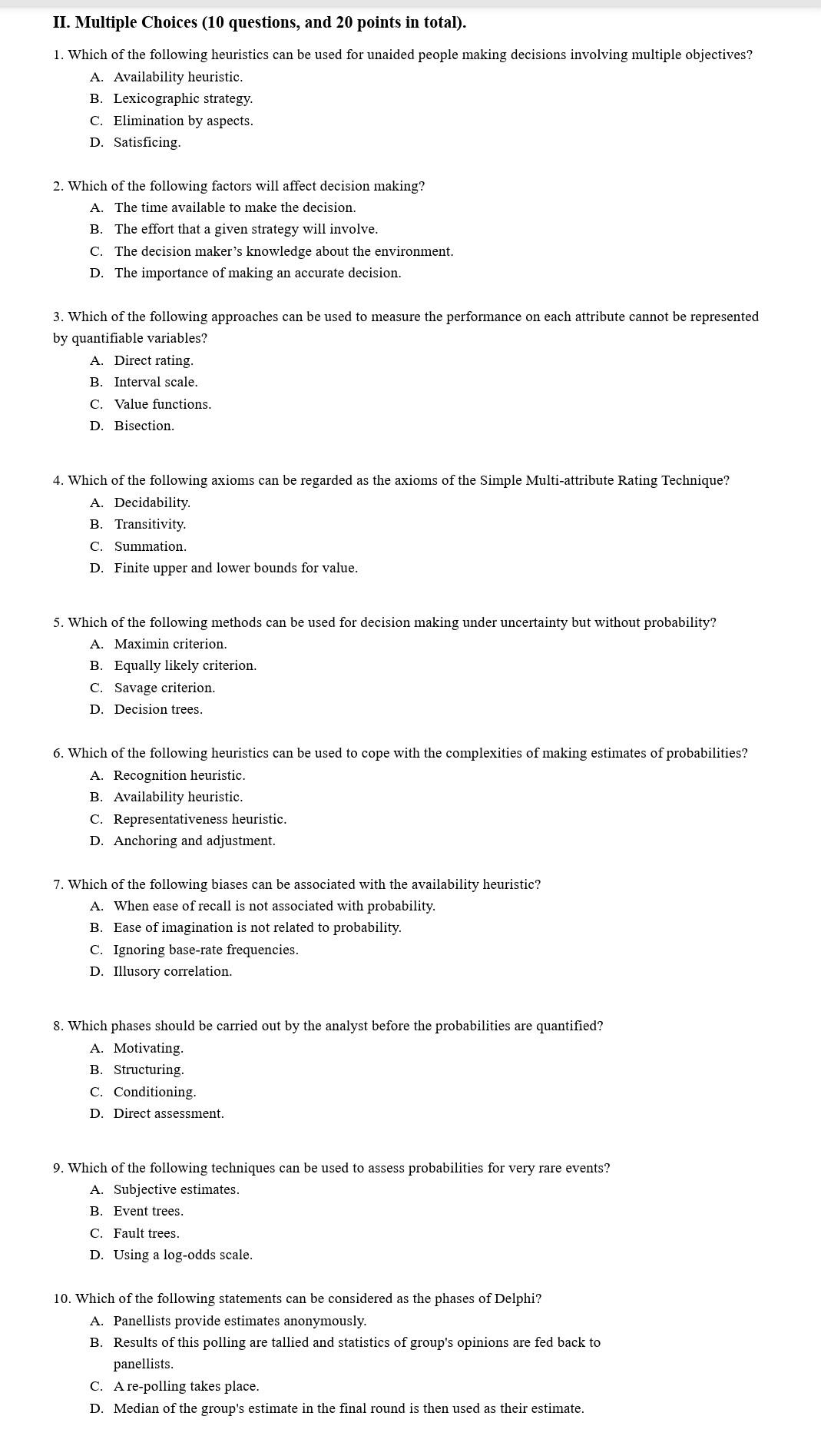

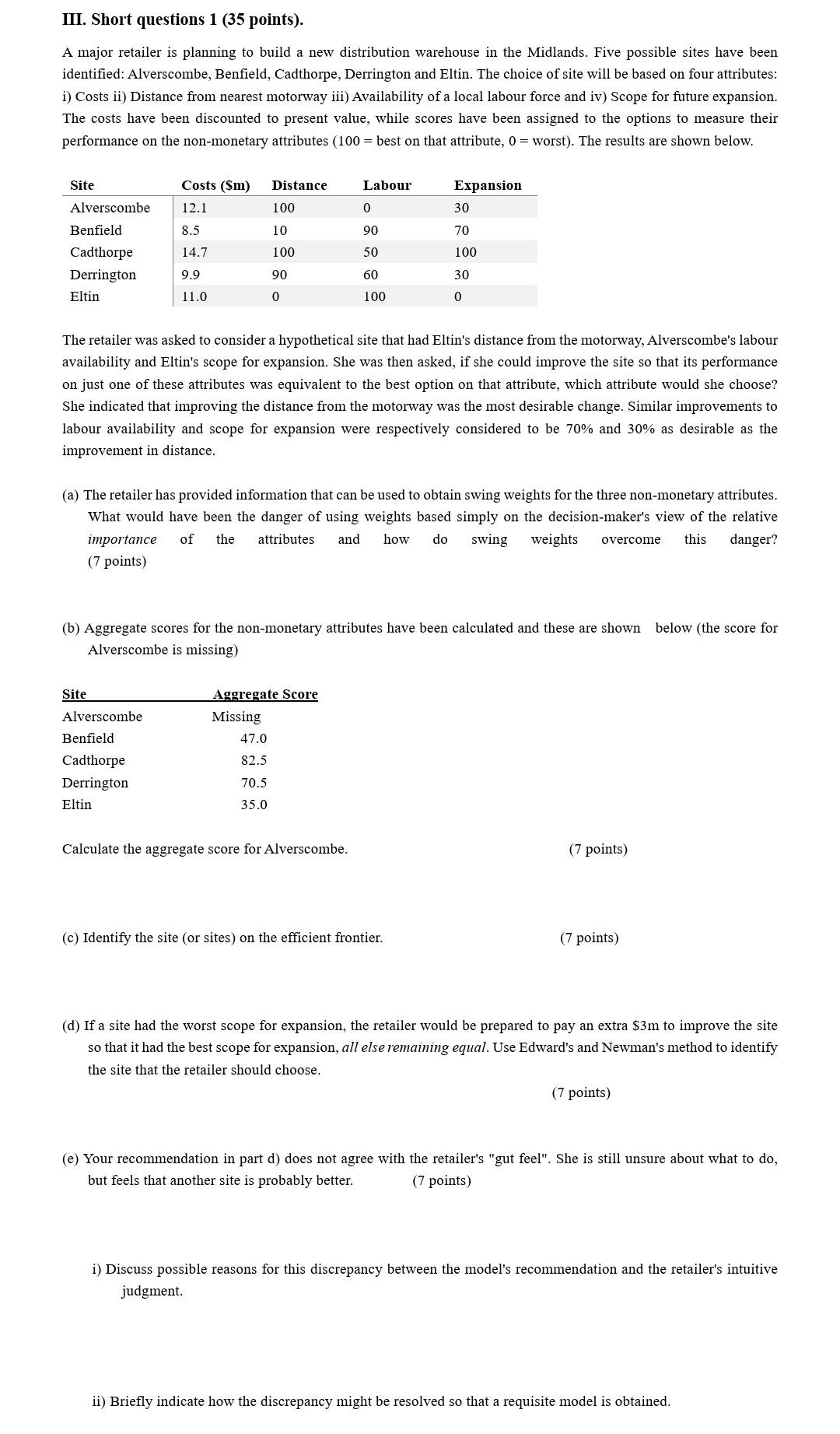

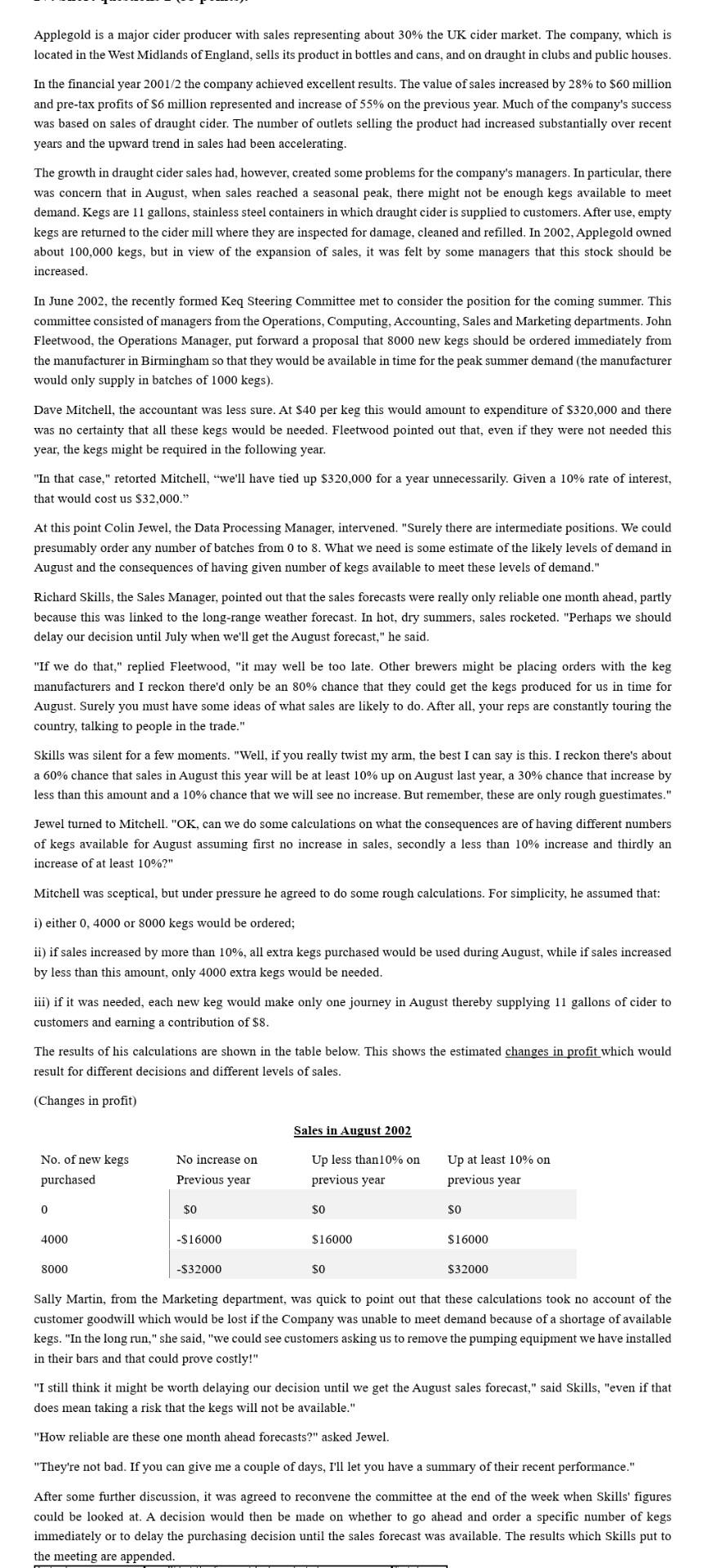

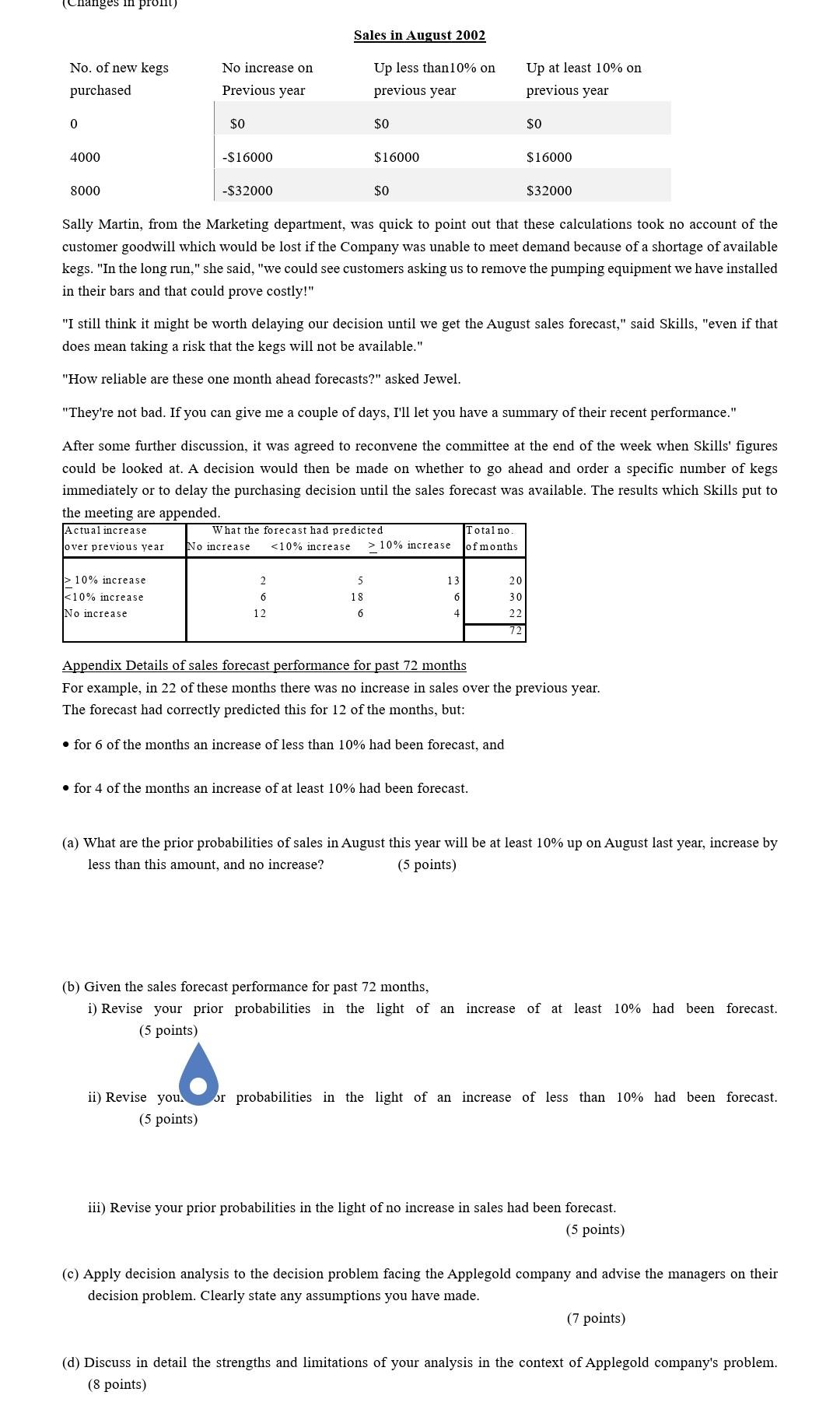

True False True False 1. Decision analysis will not solve a decision problem, nor is it intended to. Its purpose is to produce insight and promote creativity to help decision makers make better decisions. 2. If the decision doesn't involve risk and uncertainty, utility is the numerical score to measure the attractiveness of a course of action. 3. The criterion of decomposability for judging the value tree requires that the performance of an option attribute be judged independently of its performance on other attributes. 4. Swing weights can be used to compare a change from the least-preferred to the most- preferred value on one attribute to a similar change in another attribute. on one can True False True False 5. Because the decision maker does have True False True False difficulties in judging the cost-benefit trade-off, it is insufficient for them to make a choice according to the options on the efficient frontier. 6. Certainty-equivalence methods were found to yield greater risk seeking than probability- equivalence methods. 7. The expected utility implies that the decision maker regards this option as being equivalent to a lottery offering a same chance of the best/best outcome (and a complementary probability of the worst/worst outcome). True False 8. Influence diagrams cannot be regarded as a method for eliciting decision trees. True False 9. The second-degree stochastic dominance is True False better than the first-degree stochastic dominance when evaluating the highest expected utility. 10. New information can remove or reduce the uncertainty involved in a decision and thereby increase the expected payoff. True False II. Multiple Choices (10 questions, and 20 points in total). 1. Which of the following heuristics can be used for unaided people making decisions involving multiple objectives? A. Availability heuristic. B. Lexicographic strategy. C. Elimination by aspects. D. Satisficing. 2. Which of the following factors will affect decision making? A. The time available to make the decision. B. The effort that a given strategy will involve. C. The decision maker's knowledge about the environment. D. The importance of making an accurate decision. 3. Which of the following approaches can be used to measure the performance on each attribute cannot be represented by quantifiable variables? A. Direct rating. B. Interval scale. C. Value functions. D. Bisection. 4. Which of the following axioms can be regarded as the axioms of the Simple Multi-attribute Rating Technique? A. Decidability. B. Transitivity. C. Summation. D. Finite upper and lower bounds for value. 5. Which of the following methods can be used for decision making under uncertainty but without probability? A. Maximin criterion. B. Equally likely criterion. C. Savage criterion. D. Decision trees. 6. Which of the following heuristics can be used to cope with the complexities of making estimates of probabilities? A. Recognition heuristic. B. Availability heuristic. C. Representativeness heuristic. D. Anchoring and adjustment. 7. Which of the following biases can be associated with the availability heuristic? A. When ease of recall is not associated with probability. B. Ease of imagination is not related to probability. C. Ignoring base-rate frequencies. D. Illusory correlation. 8. Which phases should be carried out by the analyst before the probabilities are quantified? A. Motivating. B. Structuring. C. Conditioning. D. Direct assessment. 9. Which of the following techniques can be used to assess probabilities for very rare events? A. Subjective estimates. B. Event trees. C. Fault trees. D. Using a log-odds scale. 10. Which of the following statements can be considered as the phases of Delphi? A. Panellists provide estimates anonymously. B. Results of this polling are tallied and statistics of group's opinions are fed back to panellists. C. A re-polling takes place. D. Median of the group's estimate in the final round is then used as their estimate. III. Short questions 1 (35 points). A major retailer is planning to build a new distribution warehouse in the Midlands. Five possible sites have been identified: Alverscombe, Benfield, Cadthorpe, Derrington and Eltin. The choice of site will be based on four attributes: i) Costs ii) Distance from nearest motorway iii) Availability of a local labour force and iv) Scope for future expansion. The costs have been discounted to present value, while scores have been assigned to the options to measure their performance on the non-monetary attributes (100 = best on that attribute, 0 = worst). The results are shown below. Site Costs ($m) Distance Labour Expansion 12.1 100 0 30 8.5 10 90 70 Alverscombe Benfield Cadthorpe Derrington Eltin 14.7 100 50 100 9.9 90 60 30 11.0 0 100 0 The retailer was asked to consider a hypothetical site that had Eltin's distance from the motorway, Alverscombe's labour availability and Eltin's scope for expansion. She was then asked if she could improve the site so that its performance on just one of these attributes was equivalent to the best option on that attribute, which attribute would she choose? She indicated that improving the distance from the motorway was the most desirable change. Similar improvements to labour availability and scope for expansion were respectively considered to be 70% and 30% as desirable as the improvement in distance. (a) The retailer has provided information that can be used to obtain swing weights for the three non-monetary attributes. What would have been the danger of using weights based simply on the decision-maker's view of the relative importance of the attributes and how do swing weights this danger? (7 points) overcome below (the score for (b) Aggregate scores for the non-monetary attributes have been calculated and these are shown Alverscombe is missing) Aggregate Score Missing 47.0 Site Alverscombe Benfield Cadthorpe Derrington Eltin 82.5 70.5 35.0 Calculate the aggregate score for Alverscombe. (7 points) (c) Identify the site (or sites) on the efficient frontier. (7 points) (d) If a site had the worst scope for expansion, the retailer would be prepared to pay an extra $3m to improve the site so that it had the best scope for expansion, all else remaining equal. Use Edward's and Newman's method to identify the site that the retailer should choose. (7 points) (e) Your recommendation in part d) does not agree with the retailer's "gut feel". She is still unsure about what to do, but feels that another site is probably better. (7 points) i) Discuss possible reasons for this discrepancy between the model's recommendation and the retailer's intuitive judgment. ii) Briefly indicate how the discrepancy might be resolved so that a requisite model is obtained. IV. Short questions 2 (35 points). Applegold is a major cider producer with sales representing about 30% the UK cider market. The company, which is located in the West Midlands of England, sells its product in bottles and cans, and on draught in clubs and public houses. In the financial year 2001/2 the company achieved excellent results. The value of sales increased by 28% to $60 million and pre-tax profits of $6 million represented and increase of 55% on the previous year. Much of the company's success was based on sales of draught cider. The number of outlets selling the product had increased substantially over recent years and the upward trend in sales had been accelerating. The growth in draught cider sales had, however, created some problems for the company's managers. In particular, there was concern that in August, when sales reached a seasonal peak, there might not be enough kegs available to meet demand. Kegs are 11 gallons, stainless steel containers in which draught cider is supplied to customers. After use, empty kegs are returned to the cider mill where they are inspected for damage, cleaned and refilled. In 2002, Applegold owned about 100,000 kegs, but in view of the expansion of sales, it was felt by some managers that this stock should be increased. In June 2002, the recently formed Keq Steering Committee met to consider the position for the coming summer. This committee consisted of managers from the Operations, Computing, Accounting, Sales and Marketing departments. John Fleetwood, the Operations Manager, put forward a proposal that 8000 new kegs should be ordered immediately from the manufacturer in Birmingham so that they would be available in time for the peak summer demand (the manufacturer would only supply in batches of 1000 kegs). Dave Mitchell, the accountant was less sure. At $40 per keg this would amount to expenditure of $320,000 and there was no certainty that all these kegs would be needed. Fleetwood pointed out that, even if they were not needed this year, the kegs might be required in the following year. "In that case," retorted Mitchell, "we'll have tied up $320,000 for a year unnecessarily. Given a 10% rate of interest, that would cost us $32,000." At this point Colin Jewel, the Data Processing Manager, intervened. "Surely there are intermediate positions. We could presumably order any number of batches from 0 to 8. What we need is some estimate of the likely levels of demand in August and the consequences of having given number of kegs available to meet these levels of demand." Richard Skills, the Sales Manager, pointed out that the sales forecasts were really only reliable one month ahead, partly because this was linked to the long-range weather forecast. In hot, dry summers, sales rocketed. "Perhaps we should delay our decision until July when we'll get the August forecast," he said. "If we do that," replied Fleetwood, "it may well be too late. Other brewers might be placing orders with the keg manufacturers and I reckon there'd only be an 80% chance that they could get the kegs produced for us in time for August. Surely you must have some ideas of what sales are likely to do. After all, your reps are constantly touring the country, talking to people in the trade." Skills was silent for a few moments. "Well, if you really twist my arm, the best I can say is this. I teckon there's about a 60% chance that sales in August this year will be at least 10% up on August last year, a 30% chance that increase by less than this amount 0% chance that we will see no increase. But remember, thes are only rough guestimates." Jewel turned to Mitchell. "OK, can we do some calculations on what the consequences are of having different numbers of kegs available for August assuming first no increase in sales, secondly a less than 10% increase and thirdly an increase of at least 10%?" Mitchell was sceptical, but under pressure he agreed to do some rough calculations. For simplicity, he assumed that: i) either 0. 4000 or 8000 kegs would be ordered; ii) if sales increased by more than 10%, all extra kegs purchased would be used during August, while if sales increased by less than this amount, only 4000 extra kegs would be needed. 111) if it was needed, each new keg would make only one journey in August thereby supplying 11 gallons of cider to customers and earning a contribution of $8. The results of his calculations are shown in the table below. This shows the estimated changes in profit which would result for different decisions and different levels of sales. (Changes in profit) Sales in August 2002 No. of new kegs No increase on Up less than 10% on Up at least 10% on Applegold is a major cider producer with sales representing about 30% the UK cider market. The company, which is located in the West Midlands of England, sells its product in bottles and cans, and on draught in clubs and public houses. In the financial year 2001/2 the company achieved excellent results. The value of sales increased by 28% to $60 million and pre-tax profits of $6 million represented and increase of 55% on the previous year. Much of the company's success was based on sales of draught cider. The number of outlets selling the product had increased substantially over recent years and the upward trend in sales had been accelerating. The growth in draught cider sales had, however, created some problems for the company's managers. In particular, there was concern that in August, when sales reached a seasonal peak, there might not be enough kegs available to meet demand. Kegs are 11 gallons, stainless steel containers in which draught cider is supplied to customers. After use, empty kegs are returned to the cider mill where they are inspected for damage, cleaned and refilled. In 2002, Applegold owned about 100,000 kegs, but in view of the expansion of sales, it was felt by some managers that this stock should be increased In June 2002, the recently formed Keq Steering Committee met to consider the position for the coming summer. This committee consisted of managers from the Operations, Computing, Accounting, Sales and Marketing departments. John Fleetwood, the Operations Manager, put forward a proposal that 8000 new kegs should be ordered immediately from the manufacturer in Birmingham so that they would be available in time for the peak summer demand (the manufacturer would only supply in batches of 1000 kegs). Dave Mitchell, the accountant was less sure. At $40 per keg this would amount to expenditure of $320,000 and there was no certainty that all these kegs would be needed. Fleetwood pointed out that, even if they were not needed this year, the kegs might be required in the following year. "In that case," retorted Mitchell, we'll have tied up $320,000 for a year unnecessarily. Given a 10% rate of interest, that would cost us $32.000." At this point Colin Jewel, the Data Processing Manager, intervened. "Surely there are intermediate positions. We could presumably order any number of batches from 0 to 8. What we need is some estimate of the likely levels of demand in August and the consequences of having given number of kegs available to meet these levels of demand." Richard Skills, the Sales Manager, pointed out that the sales forecasts were really only reliable one month ahead, partly because this was linked to the long-range weather forecast. In hot, dry summers, sales rocketed. "Perhaps we should delay our decision until July when we'll get the August forecast," he said. "If we do that," replied Fleetwood, "it may well be too late. Other brewers might be placing orders with the keg manufacturers and I reckon there'd only be an 80% chance that they could get the kegs produced for us in time for August. Surely you must have some ideas of what sales are likely to do. After all, your reps are constantly touring the country, talking to people in the trade." Skills was silent for a few moments. "Well, if you really twist my arm, the best I can say is this. I reckon there's about a 60% chance that sales in August this year will be at least 10% up on August last year, a 30% chance that increase by less than this amount and a 10% chance that we will see no increase. But remember, these are only rough guestimates." Jewel turned to Mitchell. "OK, can we do some calculations on what the consequences are of having different numbers of kegs available for August assuming first no increase in sales, secondly a less than 10% increase and thirdly an increase of at least 10%?" Mitchell was sceptical, but under pressure he agreed to do some rough calculations. For simplicity, he assumed that: i) either 0, 4000 or 8000 kegs would be ordered; ii) if sales increased by more than 10%, all extra kegs purchased would be used during August, while if sales increased by less than this amount, only 4000 extra kegs would be needed. iii) if it was needed, each new keg would make only one journey in August thereby supplying 11 gallons of cider to customers and earning a contribution of $8. The results of his calculations are shown the table below. This shows the estimated changes in profit which would result for different decisions and different levels of sales. (Changes in profit) Sales in August 2002 No. of new kegs purchased No increase on Previous year Up less than 10% on previous year Up at least 10% on previous year 0 $0 $0 SO 4000 -S16000 $16000 S16000 8000 -$32000 $0 $32000 Sally Martin, from the Marketing department, was quick to point out that these calculations took no account of the customer goodwill which would be lost if the Company was unable to meet demand because of a shortage of available kegs. "In the long run," she said, "we could see customers asking us to remove the pumping equipment we have installed in their bars and that could prove costly!" "I still think it might be worth delaying our decision until we get the August sales forecast," said Skills, "even if t does mean taking a risk that the kegs will not be available." "How reliable are these one month ahead forecasts?" asked Jewel. "They're not bad. If you can give me a couple of days, I'll let you have a summary of their recent performance." After some further discussion, it was agreed to reconvene the committee at the end of the week when Skills' figures could be looked at. A decision would then be made on whether to go ahead and order a specific number of kegs immediately or to delay the purchasing decision until the sales forecast was available. The results which Skills put to the meeting are appended. (Changes in pron) Sales in August 2002 No. of new kegs purchased No increase on Previous year Up less than 10% on previous year Up at least 10% on previous year 0 $0 $0 $0 4000 -$16000 $16000 $16000 8000 -$32000 $0 $32000 Sally Martin, from the Marketing department, was quick to point out that these calculations took no account of the customer goodwill which would be lost if the Company was unable to meet demand because of a shortage of available kegs. "In the long run," she said, "we could see customers asking us to remove the pumping equipment we have installed in their bars and that could prove costly!" "I still think it might be worth delaying our decision until we get the August sales forecast," said Skills, "even if that does mean taking a risk that the kegs will not be available." "How reliable are these one month ahead forecasts?" asked Jewel. "They're not bad. If you can give me a couple of days, I'll let you have a summary of their recent performance." After some further discussion, it was agreed to reconvene the committee at the end of the week when Skills' figures could be looked at. A decision would then be made on whether to go ahead and order a specific number of kegs immediately or to delay the purchasing decision until the sales forecast was available. The results which Skills put to the meeting are appended. What the forecast had predicted > 10% increase Actual increase over previous year Totalno Jof months No increase 10% increase

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock