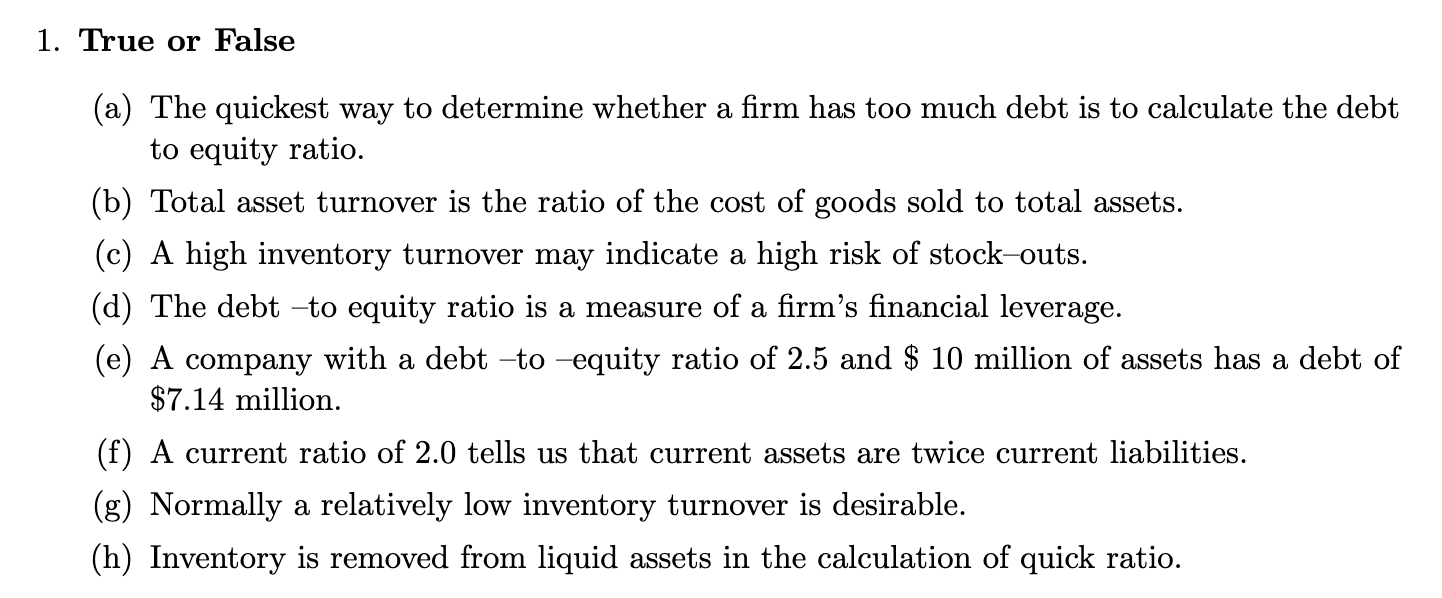

Question: True or False ( a ) The quickest way to determine whether a firm has too much debt is to calculate the debt to equity

True or False

a The quickest way to determine whether a firm has too much debt is to calculate the debt

to equity ratio.

b Total asset turnover is the ratio of the cost of goods sold to total assets.

c A high inventory turnover may indicate a high risk of stockouts.

d The debt to equity ratio is a measure of a firm's financial leverage.

e A company with a debt to equity ratio of and $ million of assets has a debt of

$ million.

f A current ratio of tells us that current assets are twice current liabilities.

g Normally a relatively low inventory turnover is desirable.

h Inventory is removed from liquid assets in the calculation of quick ratio.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock