Question: True or False, if false, explain. d.) The average rate of return must be equal to the net income divided by average investment. e.) When

True or False, if false, explain.

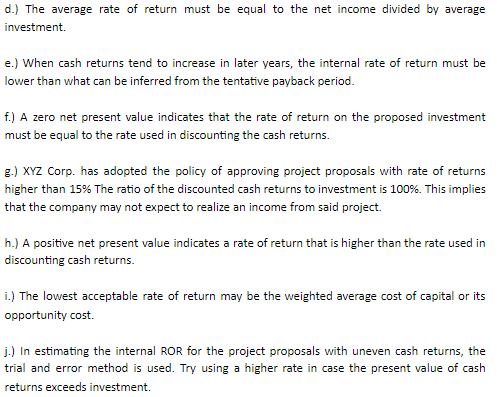

d.) The average rate of return must be equal to the net income divided by average investment. e.) When cash returns tend to increase in later years, the internal rate of return must be lower than what can be inferred from the tentative payback period. f.) A zero net present value indicates that the rate of return on the proposed investment must be equal to the rate used in discounting the cash returns. 3.) XYZ Corp. has adopted the policy of approving project proposals with rate of returns higher than 15% The ratio of the discounted cash returns to investment is 100%. This implies that the company may not expect to realize an income from said project. h.) A positive net present value indicates a rate of return that is higher than the rate used in discounting cash returns. i.) The lowest acceptable rate of return may be the weighted average cost of capital or its opportunity cost. j.) In estimating the internal ROR for the project proposals with uneven cash returns, the trial and error method is used. Try using a higher rate in case the present value of cash returns exceeds investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts