Question: true or False? if false, please state why it is false Basis risk arises from the hedger's uncertainty as to the difference between the spot

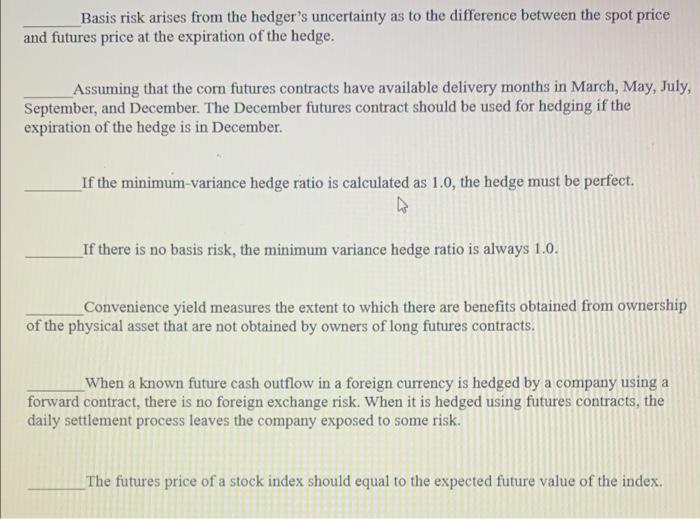

Basis risk arises from the hedger's uncertainty as to the difference between the spot price and futures price at the expiration of the hedge. Assuming that the corn futures contracts have available delivery months in March, May, July, September , and December. The December futures contract should be used for hedging if the expiration of the hedge is in December. If the minimum-variance hedge ratio is calculated as 1.0, the hedge must be perfect. If there is no basis risk, the minimum variance hedge ratio is always 1.0. Convenience yield measures the extent to which there are benefits obtained from ownership of the physical asset that are not obtained by owners of long futures contracts. When a known future cash outflow in a foreign currency is hedged by a company using a forward contract, there is no foreign exchange risk. When it is hedged using futures contracts, the daily settlement process leaves the company exposed to some risk. The futures price of a stock index should equal to the expected future value of the index

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts