Question: TRUE OR FALSE ooo O O 10. It is fair to assume that a negative correlation between two assets produces a portfolio standard deviation equal

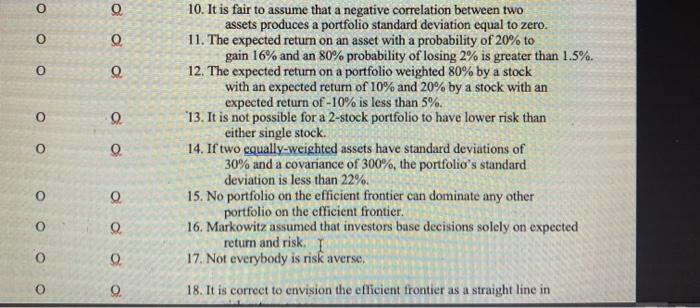

ooo O O 10. It is fair to assume that a negative correlation between two assets produces a portfolio standard deviation equal to zero. 11. The expected return on an asset with a probability of 20% to gain 16% and an 80% probability of losing 2% is greater than 1.5%. 12. The expected return on a portfolio weighted 80% by a stock with an expected return of 10% and 20% by a stock with an expected return of -10% is less than 5%. 13. It is not possible for a 2-stock portfolio to have lower risk than either single stock. 14. If two equally-weighted assets have standard deviations of 30% and a covariance of 300%, the portfolio's standard deviation is less than 22%. 15. No portfolio on the efficient frontier can dominate any other portfolio on the efficient frontier. 16. Markowitz assumed that investors base decisions solely on expected return and risk. 1 17. Not everybody is risk averse, 18. It is correct to envision the efficient frontier as a straight line in OOOO oooo

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts