Question: TRUE OR FALSE QUESTIONS, GIVE EXPLAINATIONS TO ANSWER (1-10) Review 1 1. Securities classified as held to maturity could be reported as either current or

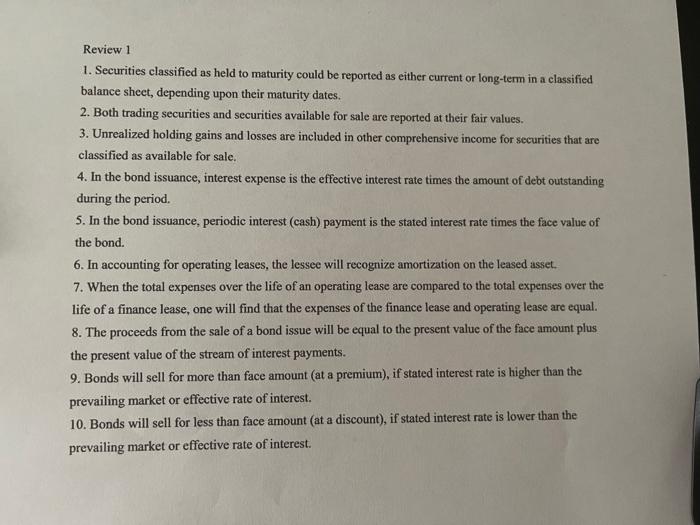

Review 1 1. Securities classified as held to maturity could be reported as either current or long-term in a classified balance sheet, depending upon their maturity dates. 2. Both trading securities and securities available for sale are reported at their fair values. 3. Unrealized holding gains and losses are included in other comprehensive income for securities that are classified as available for sale, 4. In the bond issuance, interest expense is the effective interest rate times the amount of debt outstanding during the period. 5. In the bond issuance, periodic interest (cash) payment is the stated interest rate times the face value of the bond. 6. In accounting for operating leases, the lessee will recognize amortization on the leased asset. 7. When the total expenses over the life of an operating lease are compared to the total expenses over the life of a finance lease, one will find that the expenses of the finance lease and operating lease are equal. 8. The proceeds from the sale of a bond issue will be equal to the present value of the face amount plus the present value of the stream of interest payments. 9. Bonds will sell for more than face amount at a premium), if stated interest rate is higher than the prevailing market or effective rate of interest. 10. Bonds will sell for less than face amount at a discount), if stated interest rate is lower than the prevailing market or effective rate of interest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts