Question: true or false questions please answer with an explanation ik really confused 6. A company with almost fully depreciated fixed assets is expected to have

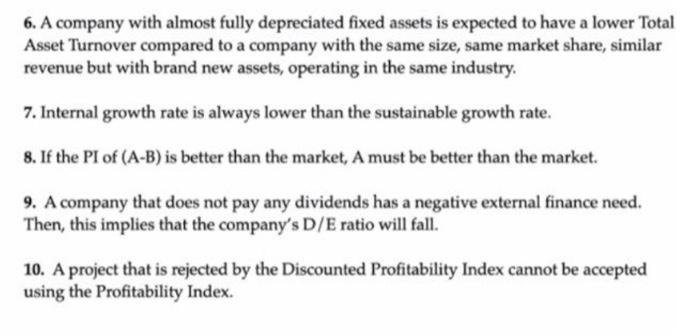

6. A company with almost fully depreciated fixed assets is expected to have a lower Total Asset Turnover compared to a company with the same size, same market share, similar revenue but with brand new assets, operating in the same industry. 7. Internal growth rate is always lower than the sustainable growth rate. 8. If the PI of (A-B) is better than the market, A must be better than the market. 9. A company that does not pay any dividends has a negative external finance need. Then, this implies that the company's D/E ratio will fall. 10. A project that is rejected by the Discounted Profitability Index cannot be accepted using the Profitability Index

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts