Question: True or false (state why T or why F) A company has issued one zero coupon bond that pays back 1000 in a year from

True or false (state why T or why F)

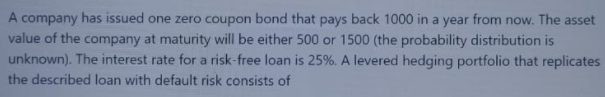

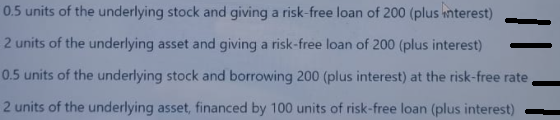

A company has issued one zero coupon bond that pays back 1000 in a year from now. The asset value of the company at maturity will be either 500 or 1500 (the probability distribution is unknown). The interest rate for a risk-free loan is 25%. A levered hedging portfolio that replicates the described loan with default risk consists of 0.5 units of the underlying stock and giving a risk-free loan of 200 (plus interest) 2 units of the underlying asset and giving a risk-free loan of 200 (plus interest) 0.5 units of the underlying stock and borrowing 200 (plus interest) at the risk-free rate 2 units of the underlying asset, financed by 100 units of risk-free loan (plus interest) A company has issued one zero coupon bond that pays back 1000 in a year from now. The asset value of the company at maturity will be either 500 or 1500 (the probability distribution is unknown). The interest rate for a risk-free loan is 25%. A levered hedging portfolio that replicates the described loan with default risk consists of 0.5 units of the underlying stock and giving a risk-free loan of 200 (plus interest) 2 units of the underlying asset and giving a risk-free loan of 200 (plus interest) 0.5 units of the underlying stock and borrowing 200 (plus interest) at the risk-free rate 2 units of the underlying asset, financed by 100 units of risk-free loan (plus interest)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts