Question: True or False these please :) Chapter 13 Efficient Markets & Behavioral Finance True-False (1 point each for a total of 6 points) 14. If

True or False these please :)

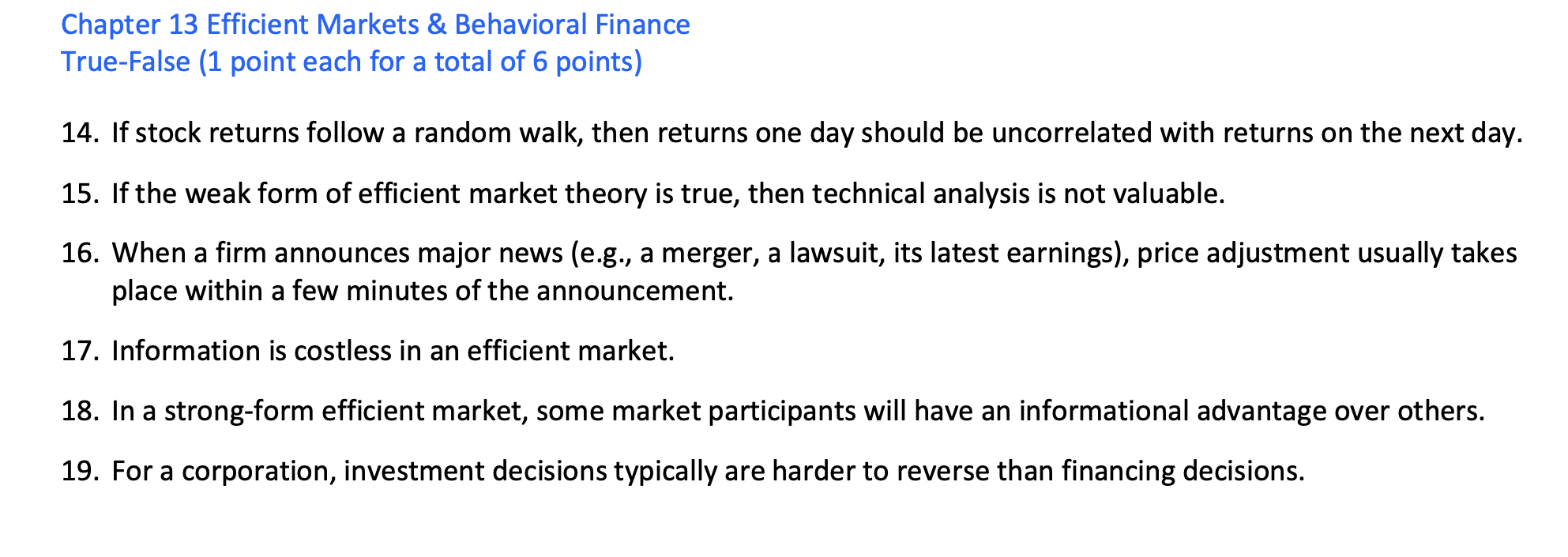

Chapter 13 Efficient Markets & Behavioral Finance True-False (1 point each for a total of 6 points) 14. If stock returns follow a random walk, then returns one day should be uncorrelated with returns on the next day. 15. If the weak form of efficient market theory is true, then technical analysis is not valuable. 16. When a firm announces major news (e.g., a merger, a lawsuit, its latest earnings), price adjustment usually takes place within a few minutes of the announcement. 17. Information is costless in an efficient market. 18. In a strong-form efficient market, some market participants will have an informational advantage over others. 19. For a corporation, investment decisions typically are harder to reverse than financing decisions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts