Question: True/False and Multiple Choice. 3 Points Each. 1. Which of the following is a characteristic of a current liability but not a long-term liability? A)

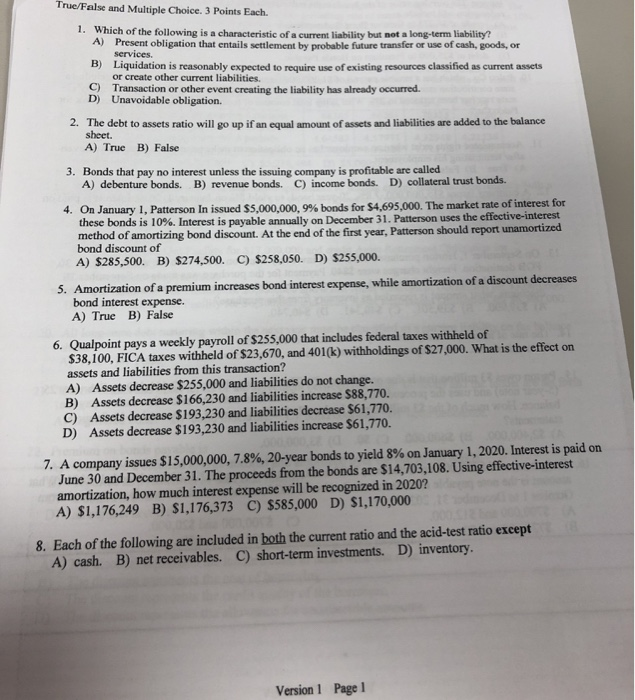

True/False and Multiple Choice. 3 Points Each. 1. Which of the following is a characteristic of a current liability but not a long-term liability? A) Present obligation that entails settlement by probable future transfer or use of cash, goods, or services B) Liquidation is reasonably expected to require use of existing resources classified as current assets or create other current liabilities. C) Transaction or other event creating the liability has already occurred. D) Unavoidable obligation. 2. The debt to assets ratio will go up if an equal amount of assets and liabilities are added to the balance sheet. A) True B) False 3. Bonds that pay no interest unless the issuing company is profitable are called A) debenture bonds. B) revenue bonds. C) income bonds. D) collateral trust bonds. 4. On January 1, Patterson In issued $5,000,000, 9% bonds for $4.695,000. The market rate of interest for these bonds is 10%. Interest is payable annually on December 31. Patterson uses the effective-interest method of amortizing bond discount. At the end of the first year, Patterson should report unamortized bond discount of A) $285,500. B) $274,500. C) $258,050. D) $255,000. 5. Amortization of a premium increases bond interest expense, while amortization of a discount decreases bond interest expense. A) True B) False 6. Qualpoint pays a weekly payroll of $255,000 that includes federal taxes withheld of $38,100, FICA taxes withheld of $23,670, and 401(k) withholdings of $27,000. What is the effect on assets and liabilities from this transaction? A) Assets decrease $255,000 and liabilities do not change. B) Assets decrease $166,230 and liabilities increase $88,770. C) Assets decrease $193,230 and liabilities decrease $61,770. D) Assets decrease $193,230 and liabilities increase $61,770. 7. A company issues $15,000,000, 7.8%, 20-year bonds to yield 8% on January 1, 2020. Interest is paid on June 30 and December 31. The proceeds from the bonds are $14,703,108. Using effective interest amortization, how much interest expense will be recognized in 2020? A) $1,176,249 B) $1,176,373 C) $585,000 D) $1,170,000 8. Each of the following are included in both the current ratio and the acid-test ratio except A) cash. B) net receivables. C) short-term investments. D) inventory. Version 1 Page 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts