Question: True/False Questions (1 mark each) Q1: Delta hedging a long option position over its lifetime will usually make money if realised volatility is greater than

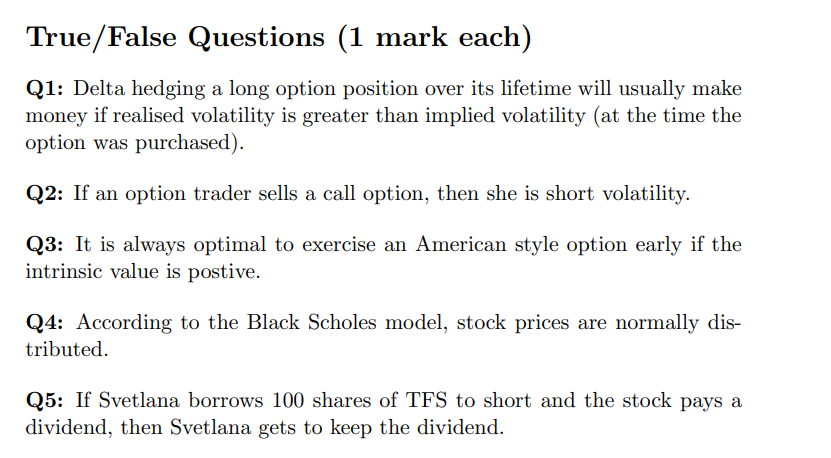

True/False Questions (1 mark each) Q1: Delta hedging a long option position over its lifetime will usually make money if realised volatility is greater than implied volatility (at the time the option was purchased). Q2: If an option trader sells a call option, then she is short volatility. Q3: It is always optimal to exercise an American style option early if the intrinsic value is postive. Q4: According to the Black Scholes model, stock prices are normally dis- tributed. Q5: If Svetlana borrows 100 shares of TFS to short and the stock pays a dividend, then Svetlana gets to keep the dividend

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts