Question: Trying to solve this, please help. Thank you! Homework 2.2: Simple Budget Projections Note: You will need to open the Excel file called Homework 2.2_budget

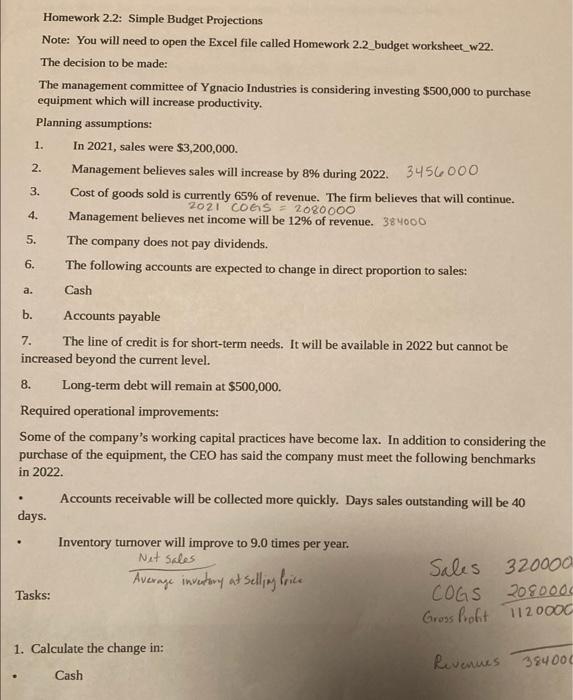

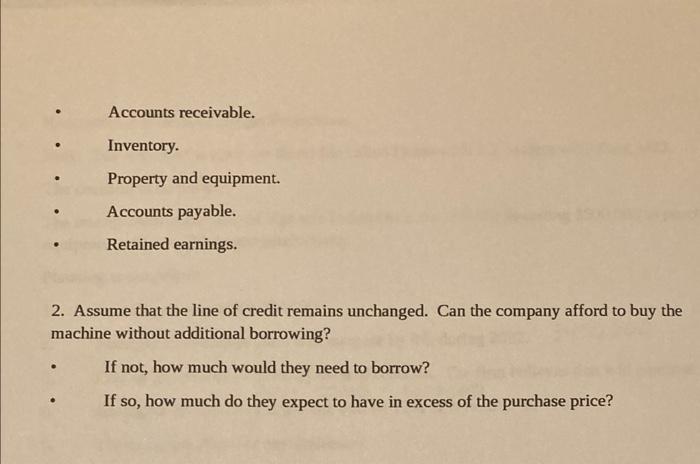

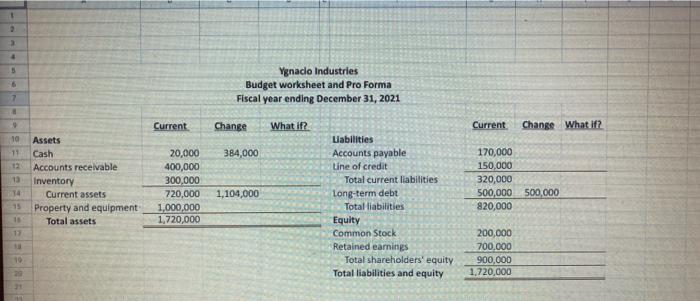

Homework 2.2: Simple Budget Projections Note: You will need to open the Excel file called Homework 2.2_budget worksheet_w22. The decision to be made: 1. 4. a. The management committee of Ygnacio Industries is considering investing $500,000 to purchase equipment which will increase productivity. Planning assumptions: In 2021, sales were $3,200,000. 2. Management believes sales will increase by 8% during 2022. 3450 000 3. Cost of goods sold is currently 65% of revenue. The firm believes that will continue. 2021 COGS - 2080000 Management believes net income will be 12% of revenue. 384000 5. The company does not pay dividends. 6. The following accounts are expected to change in direct proportion to sales: Cash b. Accounts payable The line of credit is for short-term needs. It will be available in 2022 but cannot be increased beyond the current level. 8. Long-term debt will remain at $500,000. Required operational improvements: Some of the company's working capital practices have become lax. In addition to considering the purchase of the equipment, the CEO has said the company must meet the following benchmarks in 2022 Accounts receivable will be collected more quickly. Days sales outstanding will be 40 days. Inventory turnover will improve to 9.0 times per year. Net sales Sales 320000 Average inventory at selling price Tasks: COGS 2080000 7. Gross Bophit 1120000 1. Calculate the change in: Revenues 384000 Cash Accounts receivable. Inventory. Property and equipment. Accounts payable. Retained earnings. 2. Assume that the line of credit remains unchanged. Can the company afford to buy the machine without additional borrowing? If not, how much would they need to borrow? If so, how much do they expect to have in excess of the purchase price? 1 2 4 5 Ygnacio Industries Budget worksheet and Pro Forma Fiscal year ending December 31, 2021 7 Current Change What if? Current Change What if? 384,000 10 11 12 ta 74 13 13 1 Assets Cash Accounts receivable Inventory Current assets Property and equipment Total assets 20,000 400,000 300,000 720,000 1,000,000 1,720,000 Uabilities Accounts payable Line of credit Total current liabilities Long-term debt Total liabilities Equity Common Stock Retained earnings Total shareholders' equity Total liabilities and equity 170,000 150,000 320,000 500,000 500,000 820,000 1,104,000 200,000 700.000 900,000 1,720,000 19 23 Homework 2.2: Simple Budget Projections Note: You will need to open the Excel file called Homework 2.2_budget worksheet_w22. The decision to be made: 1. 4. a. The management committee of Ygnacio Industries is considering investing $500,000 to purchase equipment which will increase productivity. Planning assumptions: In 2021, sales were $3,200,000. 2. Management believes sales will increase by 8% during 2022. 3450 000 3. Cost of goods sold is currently 65% of revenue. The firm believes that will continue. 2021 COGS - 2080000 Management believes net income will be 12% of revenue. 384000 5. The company does not pay dividends. 6. The following accounts are expected to change in direct proportion to sales: Cash b. Accounts payable The line of credit is for short-term needs. It will be available in 2022 but cannot be increased beyond the current level. 8. Long-term debt will remain at $500,000. Required operational improvements: Some of the company's working capital practices have become lax. In addition to considering the purchase of the equipment, the CEO has said the company must meet the following benchmarks in 2022 Accounts receivable will be collected more quickly. Days sales outstanding will be 40 days. Inventory turnover will improve to 9.0 times per year. Net sales Sales 320000 Average inventory at selling price Tasks: COGS 2080000 7. Gross Bophit 1120000 1. Calculate the change in: Revenues 384000 Cash Accounts receivable. Inventory. Property and equipment. Accounts payable. Retained earnings. 2. Assume that the line of credit remains unchanged. Can the company afford to buy the machine without additional borrowing? If not, how much would they need to borrow? If so, how much do they expect to have in excess of the purchase price? 1 2 4 5 Ygnacio Industries Budget worksheet and Pro Forma Fiscal year ending December 31, 2021 7 Current Change What if? Current Change What if? 384,000 10 11 12 ta 74 13 13 1 Assets Cash Accounts receivable Inventory Current assets Property and equipment Total assets 20,000 400,000 300,000 720,000 1,000,000 1,720,000 Uabilities Accounts payable Line of credit Total current liabilities Long-term debt Total liabilities Equity Common Stock Retained earnings Total shareholders' equity Total liabilities and equity 170,000 150,000 320,000 500,000 500,000 820,000 1,104,000 200,000 700.000 900,000 1,720,000 19 23

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts