Question: ttention Due to a bug in Google Chrome, this page may not function correctly. Click here to learn more 13. Vocabulary - Annuities SE Aa

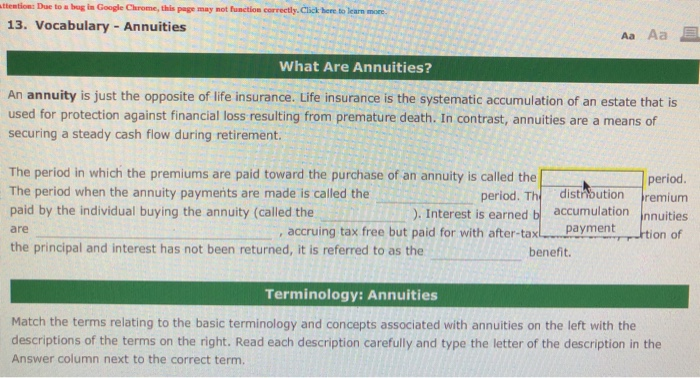

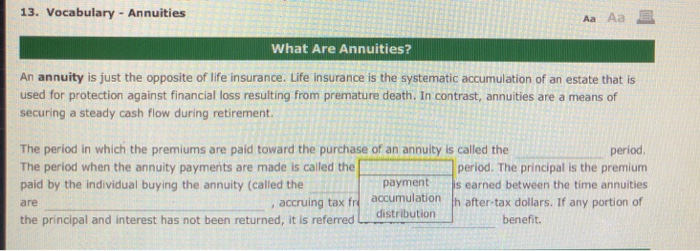

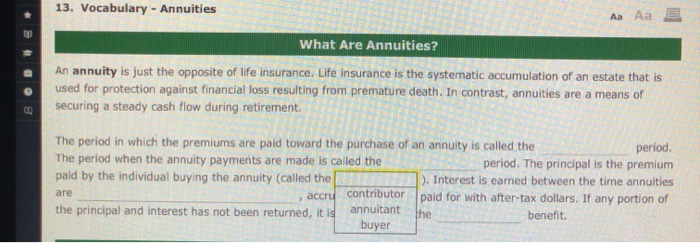

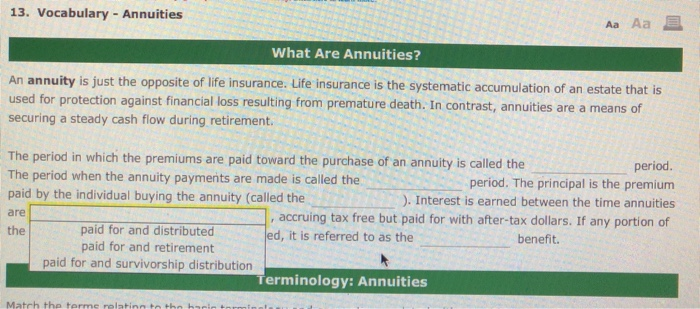

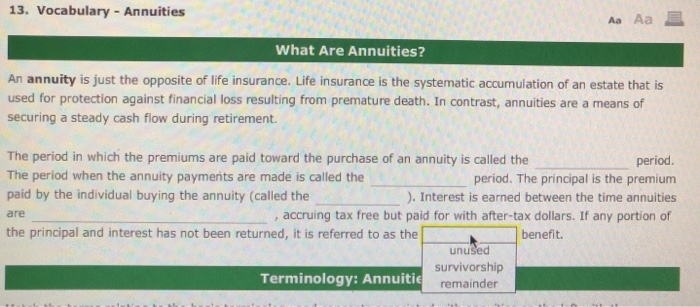

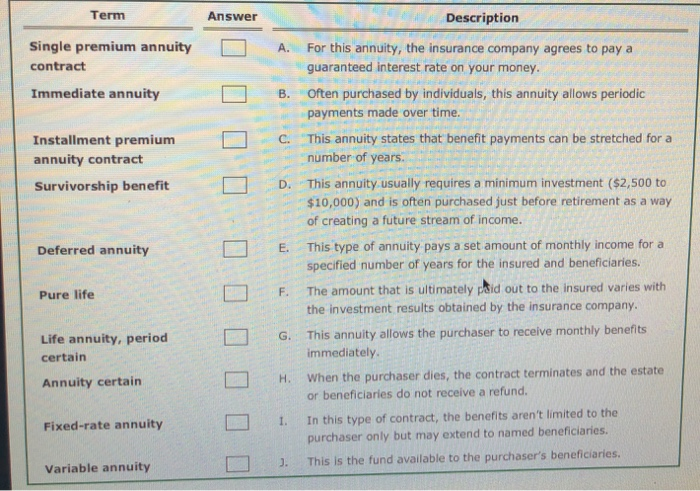

ttention Due to a bug in Google Chrome, this page may not function correctly. Click here to learn more 13. Vocabulary - Annuities SE Aa Aa E What Are Annuities? An annuity is just the opposite of life insurance. Life insurance is the systematic accumulation of an estate that is used for protection against financial loss resulting from premature death. In contrast, annuities are a means of securing a steady cash flow during retirement The period in which the premiums are paid toward the purchase of an annuity is called the period. The period when the annuity payments are made is called the period. The distrution Premium paid by the individual buying the annuity (called the ). Interest is earned bl accumulation Innuities are accruing tax free but paid for with after-tax p ayme the principal and interest has not been returned, it is referred to as the benefit. payment Ftion of Terminology: Annuities Match the terms relating to the basic terminology and concepts associated with annuities on the left with the descriptions of the terms on the right. Read each description carefully and type the letter of the description in the Answer column next to the correct term. 13. Vocabulary - Annuities What Are Annuities? An annuity is just the opposite of life insurance. Life insurance is the systematic accumulation of an estate that is used for protection against financial loss resulting from premature death. In contrast, annuities are a means of securing a steady cash flow during retirement period The period in which the premiums are paid toward the purchase of an annuity is called the The period when the annuity payments are made is called the period. The principal is the premium paid by the individual buying the annuity (called the payment is earned between the time annuities are , accruing tax fre accumulationth after-tax dollars. If any portion of 1 distribution benefit the principal and interest has not been returned, it is referred 13. Vocabulary - Annuities Aa Aa E What Are Annuities? An annuity is just the opposite of life insurance. Life insurance is the systematic accumulation of an estate that is used for protection against financial loss resulting from premature death. In contrast, annuities are a means of securing a steady cash flow during retirement, The period in which the premiums are paid toward the purchase of an annuity is called the period The period when the annuity payments are made is called the period. The principal is the premium paid by the individual buying the annuity (called the ). Interest is earned between the time annuities accru contributor paid for with after-tax dollars. If any portion of the principal and interest has not been returned, it is annuitant benefit. buyer are 13. Vocabulary - Annuities Aa E What Are Annuities? An annuity is just the opposite of life insurance. Life insurance is the systematic accumulation of an estate that is used for protection against financial loss resulting from premature death. In contrast, annuities are a means of securing a steady cash flow during retirement. The period in which the premiums are paid toward the purchase of an annuity is called the period. The period when the annuity payments are made is called the period. The principal is the premium paid by the individual buying the annuity (called the ). Interest is earned between the time annuities are accruing tax free but paid for with after-tax dollars. If any portion of the paid for and distributed ed, it is referred to as the benefit. paid for and retirement paid for and survivorship distribution Terminology: Annuities 13. Vocabulary - Annuities Aa Aa E What Are Annuities? An annuity is just the opposite of life insurance. Life insurance is the systematic accumulation of an estate that is used for protection against financial loss resulting from premature death. In contrast, annuities are a means of securing a steady cash flow during retirement The period in which the premiums are paid toward the purchase of an annuity is called the period. The period when the annuity payments are made is called the period. The principal is the premium paid by the individual buying the annuity (called the ). Interest is earned between the time annuities are accruing tax free but paid for with after-tax dollars. If any portion of the principal and interest has not been returned, it is referred to as the benefit unused survivorship Terminology: Annuitie remainder Term Single premium annuity contract Immediate annuity Description s A. insurance company aree tenan For this annuity, the insurance company agrees to pay a guaranteed interest rate on your money. B. Often purchased by individuals, this annuity allows periodic payments made over time. S U C. This annuity states that benefit payments can be stretched for a number of years. D. This annuity usually requires a minimum investment ($2,500 to $10,000) and is often purchased just before retirement as a way of creating a future stream of income. Installment premium annuity contract Survivorship benefit . OOOO 0000 Deferred annuity E. Pure life F. G Life annuity, period certain Annuity certain This type of annuity pays a set amount of monthly income for a specified number of years for the insured and beneficiaries. The amount that is ultimately paid out to the insured varies with the investment results obtained by the insurance company. This annuity allows the purchaser to receive monthly benefits immediately When the purchaser dies, the contract terminates and the estate or beneficiaries do not receive a refund. In this type of contract, the benefits aren't limited to the purchaser only but may extend to named beneficiaries. This is the fund available to the purchaser's beneficiaries. H. Fixed-rate annuity 1. Variable annuity D J

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts