Question: TUTORIAL 2: PARTNERSHIP. 1. Wan, Mat and Saman formed a partnership on Apr 1, 2005 and prepared the first set of accounts to Jan 31,

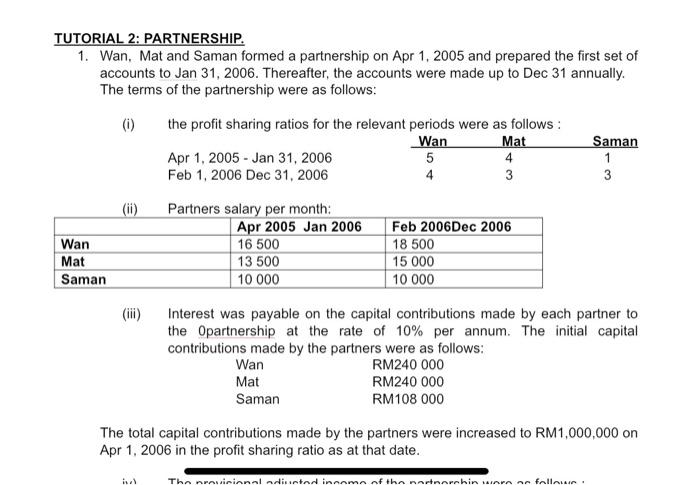

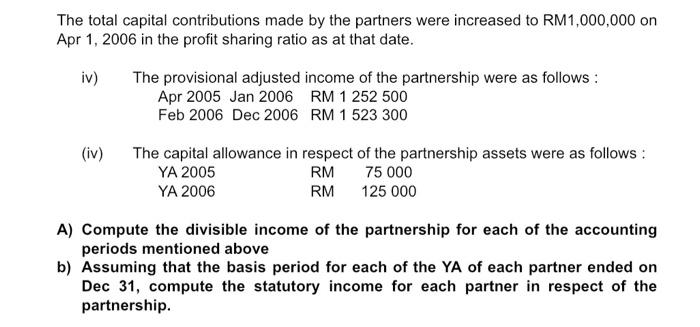

TUTORIAL 2: PARTNERSHIP. 1. Wan, Mat and Saman formed a partnership on Apr 1, 2005 and prepared the first set of accounts to Jan 31, 2006. Thereafter, the accounts were made up to Dec 31 annually. The terms of the partnership were as follows: (0) Saman 1 3 3 the profit sharing ratios for the relevant periods were as follows: Wan Mat Apr 1, 2005 - Jan 31, 2006 5 4 Feb 1, 2006 Dec 31, 2006 4 3 Partners salary per month: Apr 2005 Jan 2006 Feb 2006 Dec 2006 16 500 18 500 13 500 15 000 10 000 10 000 Wan Mat Saman Interest was payable on the capital contributions made by each partner to the Opartnership at the rate of 10% per annum. The initial capital contributions made by the partners were as follows: Wan RM240 000 Mat RM240 000 Saman RM108 000 The total capital contributions made by the partners were increased to RM1,000,000 on Apr 1, 2006 in the profit sharing ratio as at that date. int The nauirinnal dimintad innamonfthanarnarnhin mar an follow The total capital contributions made by the partners were increased to RM1,000,000 on Apr 1, 2006 in the profit sharing ratio as at that date. iv) The provisional adjusted income of the partnership were as follows: Apr 2005 Jan 2006 RM 1 252 500 Feb 2006 Dec 2006 RM 1 523 300 (iv) The capital allowance in respect of the partnership assets were as follows: YA 2005 RM 75 000 YA 2006 RM 125 000 A) Compute the divisible income of the partnership for each of the accounting periods mentioned above b) Assuming that the basis period for each of the YA of each partner ended on Dec 31, compute the statutory income for each partner in respect of the partnership

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts