Question: Tutorial 9 Question 4 considered the valuation of a derivative with an unusual payoff. Specifically, when the derivative expires 6 months from now, the

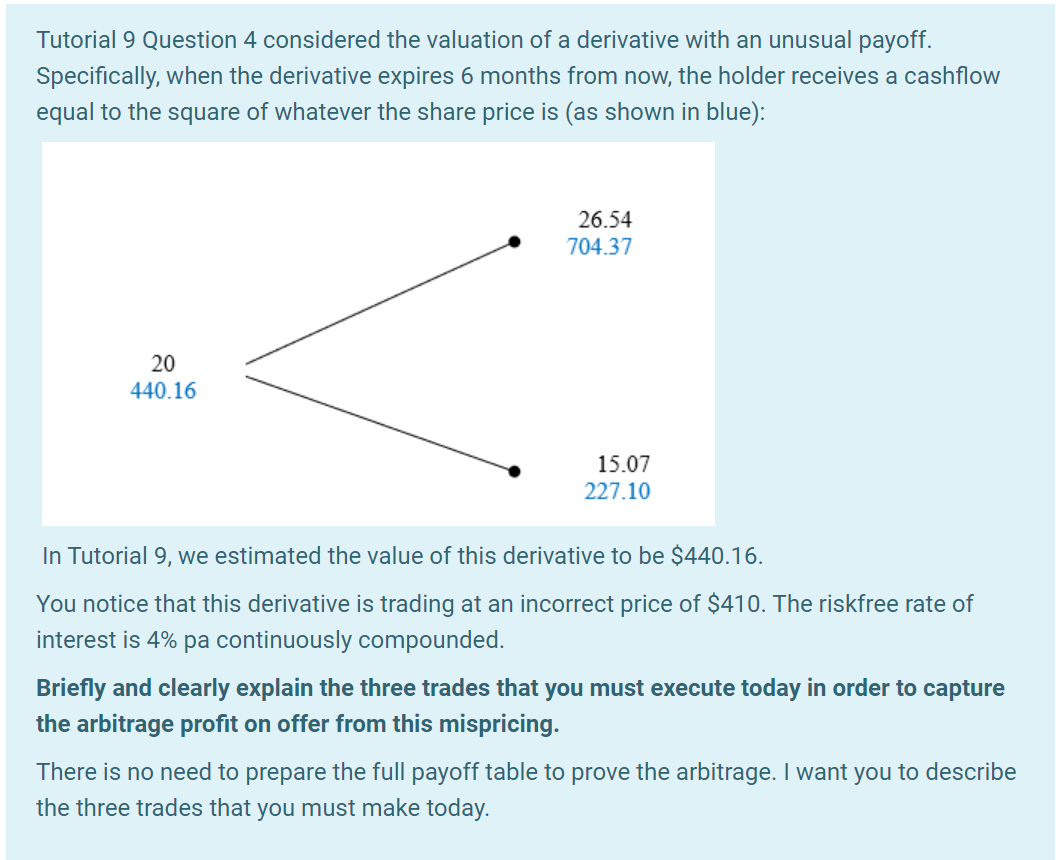

Tutorial 9 Question 4 considered the valuation of a derivative with an unusual payoff. Specifically, when the derivative expires 6 months from now, the holder receives a cashflow equal to the square of whatever the share price is (as shown in blue): 20 440.16 26.54 704.37 15.07 227.10 In Tutorial 9, we estimated the value of this derivative to be $440.16. You notice that this derivative is trading at an incorrect price of $410. The riskfree rate of interest is 4% pa continuously compounded. Briefly and clearly explain the three trades that you must execute today in order to capture the arbitrage profit on offer from this mispricing. There is no need to prepare the full payoff table to prove the arbitrage. I want you to describe the three trades that you must make today.

Step by Step Solution

3.49 Rating (166 Votes )

There are 3 Steps involved in it

Solution While talking about market participants one usually refers to either longterm investors or intraday traders conveniently leaving out a third category that of arbitrageurs Arbitrageurs are the ... View full answer

Get step-by-step solutions from verified subject matter experts