Question: TUTORIAL LETTER 1 (ASSIGNMENT 1) - 2020 FIRST SEMESTER FMA400 FINANCIAL MANAGEMENT IV Additional information: Tax rate - 30% Required: Show all calculations and round

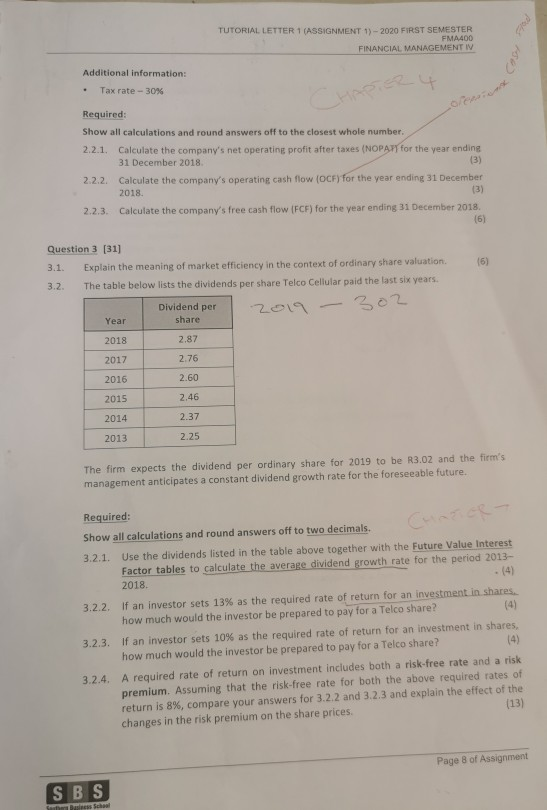

TUTORIAL LETTER 1 (ASSIGNMENT 1) - 2020 FIRST SEMESTER FMA400 FINANCIAL MANAGEMENT IV Additional information: Tax rate - 30% Required: Show all calculations and round answers off to the closest whole number 2.2.1. Calculate the company's net operating profit after taxes (NOPATY for the year ending 31 December 2018 (3) 2.2.2. Calculate the company's operating cash flow (OCF) for the year ending 31 December 2018. 2.2.3. Calculate the company's free cash flow (FCF) for the year ending 31 December 2018 (6) (3) (6) Question 3 [31] 3.1. Explain the meaning of market efficiency in the context of ordinary share valuation. 3.2. The table below lists the dividends per share Telco Cellular paid the last six years. Dividend per share 2019 - 302 Year 2018 2017 2.87 2.76 2.60 2.46 2016 2015 2014 2.37 2013 2.25 The firm expects the dividend per ordinary share for 2019 to be R3.02 and the firm's management anticipates a constant dividend growth rate for the foreseeable future. Required: Show all calculations and round answers off to two decimals. 3.2.1. Use the dividends listed in the table above together with the Future Value Interest Factor tables to calculate the average dividend growth rate for the period 2013- 2018. 3.2.2. If an investor sets 13% as the required rate of return for an investment in shares how much would the investor be prepared to pay for a Telco share? 3.2.3. If an investor sets 10% as the required rate of return for an investment in shares, how much would the investor be prepared to pay for a Telco share? 3.2.4. A required rate of return on investment includes both a risk-free rate and a risk premium. Assuming that the risk-free rate for both the above required rates of return is 8%, compare your answers for 3.2.2 and 3.2.3 and explain the effect of the (13) changes in the risk premium on the share prices. (4) Page 8 of Assignment SBS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts