Question: Tutorial Question: Objectives of Financial Statements Audit Question 1: A financial statement audit typically consists of four phases. Identify each of these four phases of

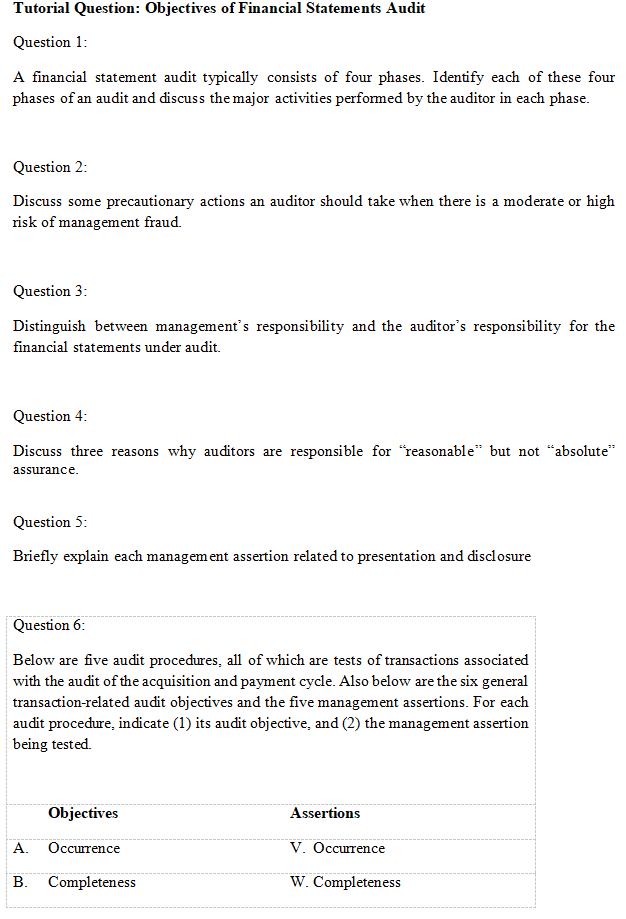

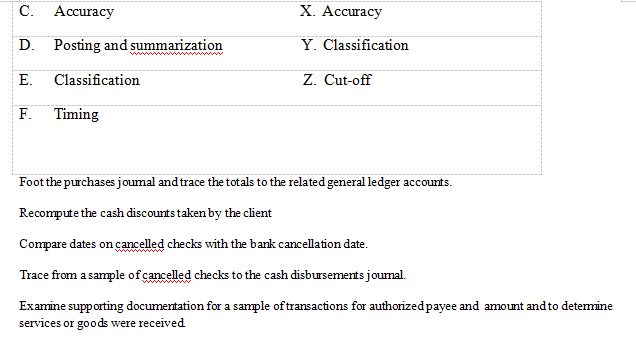

Tutorial Question: Objectives of Financial Statements Audit Question 1: A financial statement audit typically consists of four phases. Identify each of these four phases of an audit and discuss the major activities performed by the auditor in each phase. Question 2: Discuss some precautionary actions an auditor should take when there is a moderate or high risk of management fraud. Question 3: Distinguish between management's responsibility and the auditor's responsibility for the financial statements under audit. Question 4: Discuss three reasons why auditors are responsible for "reasonable" but not "absolute" assurance. Question 5: Briefly explain each management assertion related to presentation and disclosure Question 6: Below are five audit procedures, all of which are tests of transactions associated with the audit of the acquisition and payment cycle. Also below are the six general transaction-related audit objectives and the five management assertions. For each audit procedure, indicate (1) its audit objective, and (2) the management assertion being tested. Objectives Assertions A. Occurrence V. Occurrence B. Completeness W. CompletenessC. Accuracy X. Accuracy D. Posting and summarization Y. Classification E. Classification Z. Cut-off F. Timing Foot the purchases journal and trace the totals to the related general ledger accounts. Recompute the cash discounts taken by the client Compare dates on cancelled checks with the bank cancellation date. Trace from a sample of cancelled checks to the cash disbursements journal. Examine supporting documentation for a sample of transactions for authorized payee and amount and to determine services or goods were received

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts