Question: Two assets have the following expected returns and standard deviations when the risk-free rate is 5%. If you have a client for whom you estimated

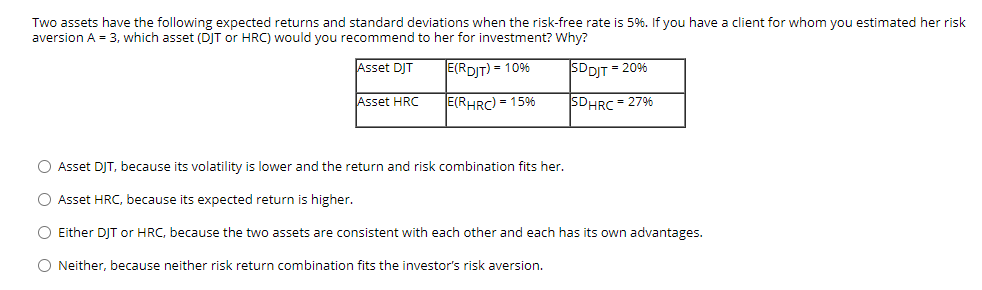

Two assets have the following expected returns and standard deviations when the risk-free rate is 5%. If you have a client for whom you estimated her risk aversion A = 3, which asset (DJT or HRC) would you recommend to her for investment? Why? Asset DJT E(RDJT) = 1096 SDDJT = 20% Asset HRC E(RHRC) = 1596 SDHRC = 2796 Asset DJT, because its volatility is lower and the return and risk combination fits her. Asset HRC, because its expected return is higher. Either DJT or HRC, because the two assets are consistent with each other and each has its own advantages. O Neither, because neither risk return combination fits the investor's risk aversion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts