Question: Two competing project proposals, 1 and 2, are currently under consideration for the manufacture of a new product line. Information for each of the

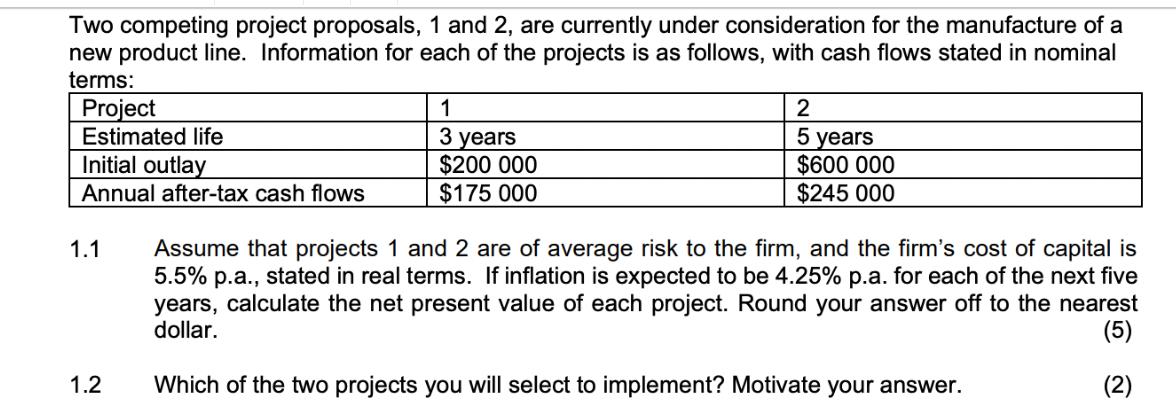

Two competing project proposals, 1 and 2, are currently under consideration for the manufacture of a new product line. Information for each of the projects is as follows, with cash flows stated in nominal terms: Project Estimated life 1 Initial outlay Annual after-tax cash flows 3 years $200 000 $175 000 1.1 2 5 years $600 000 $245 000 Assume that projects 1 and 2 are of average risk to the firm, and the firm's cost of capital is 5.5% p.a., stated in real terms. If inflation is expected to be 4.25% p.a. for each of the next five years, calculate the net present value of each project. Round your answer off to the nearest dollar. (5) 1.2 Which of the two projects you will select to implement? Motivate your answer. (2)

Step by Step Solution

There are 3 Steps involved in it

To calculate the net present value NPV of each project we need to discount the cash flows to their present values using the firms cost of capital Sinc... View full answer

Get step-by-step solutions from verified subject matter experts