Question: Two important terms when discussing Selectare correlation and correlation coefficient. Correlation is the tendency of two variables to move together, while correlation coefficient is a

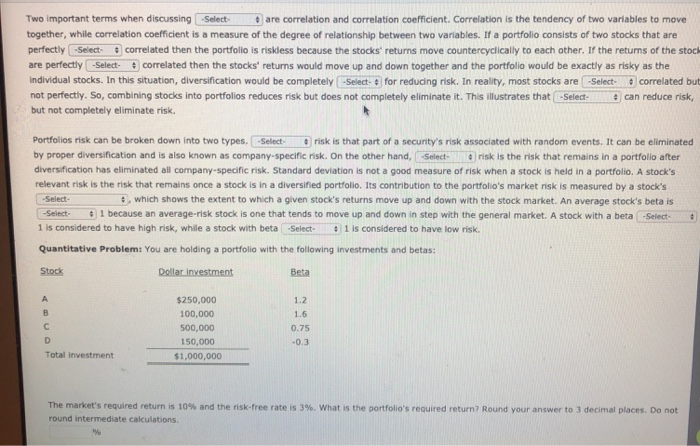

Two important terms when discussing Selectare correlation and correlation coefficient. Correlation is the tendency of two variables to move together, while correlation coefficient is a measure of the degree of relationship between two variables. If a portfolio consists of two stocks that are perfectly (-Selectcorrelated then the portfolio is riskless because the stocks' returns move countercyclically to each other. If the returns of the stock are perfectly-Selectcorrelated then the stocks' returns would move up and down together and the portfolio would be exactly as risky as the individual stocks. In this situation, diversification would be completely Select- for reducing risk. In reality, most stocks are Select-correlated but not perfectly. So, combining stocks into portfolios reduces risk but does not completely eliminate it. This illustrates that -Select can reduce risk, but not completely eliminate risk. Portfolios risk can be broken down into two types.Select-risk is that part of a security's risk associated with random events. It can be eliminated by proper diversification and is also known as company-specific risk. On the other hand,-Select- nsk is the nsk that remains la a portfolio after diversification has eliminated all company-specific risk. Standard deviation is not a good measure of risk when a stock is held in a portfolio. A stock's relevant risk is the risk that remains once a stock is in a diversified portfolio. Its contribution to the portfolio's market risk is measured by a stock's Select Select 1 because an average-risk stock is one that tends to move up and down in step with the general market. A stock with a beta Select 1 is considered to have high risk, while a stock with beta Select 1 is considered to have low risk Quantitative Problem: You are holding a portfolio with the following investments and betas: Stock 9, which shows the extent to which a given stock's returns move up and down with the stock market. An average stock's beta is Beta $250,000 100,000 500,000 150,000 $1,000,000 1.2 1.6 0.75 -0.3 Total investment The market's required return is 10% and the risk-free rate is 3%, what is the portfolio's required return? Round your answer to 3 decimal places. Do not round intermediate calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts