Question: Two investors, A and B, each with a mean-variance objective, choose their portfolios from among 20 risky assets. They agree about the values of

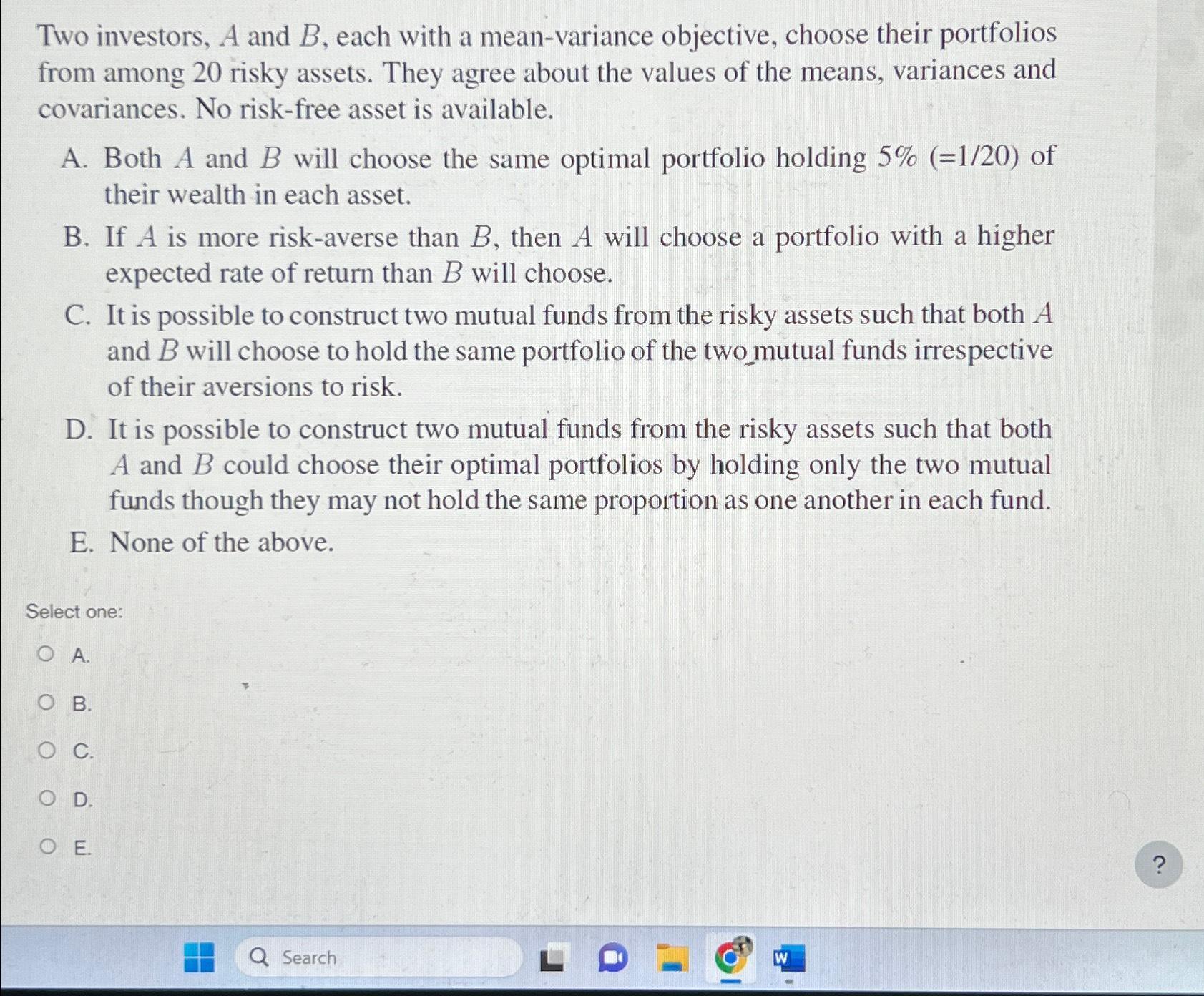

Two investors, A and B, each with a mean-variance objective, choose their portfolios from among 20 risky assets. They agree about the values of the means, variances and covariances. No risk-free asset is available. A. Both A and B will choose the same optimal portfolio holding 5% (=1/20) of their wealth in each asset. B. If A is more risk-averse than B, then A will choose a portfolio with a higher expected rate of return than B will choose. C. It is possible to construct two mutual funds from the risky assets such that both A and B will choose to hold the same portfolio of the two mutual funds irrespective of their aversions to risk. D. It is possible to construct two mutual funds from the risky assets such that both A and B could choose their optimal portfolios by holding only the two mutual funds though they may not hold the same proportion as one another in each fund. E. None of the above. Select one: OA. O B. C. OD. . Q Search W

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below The ... View full answer

Get step-by-step solutions from verified subject matter experts