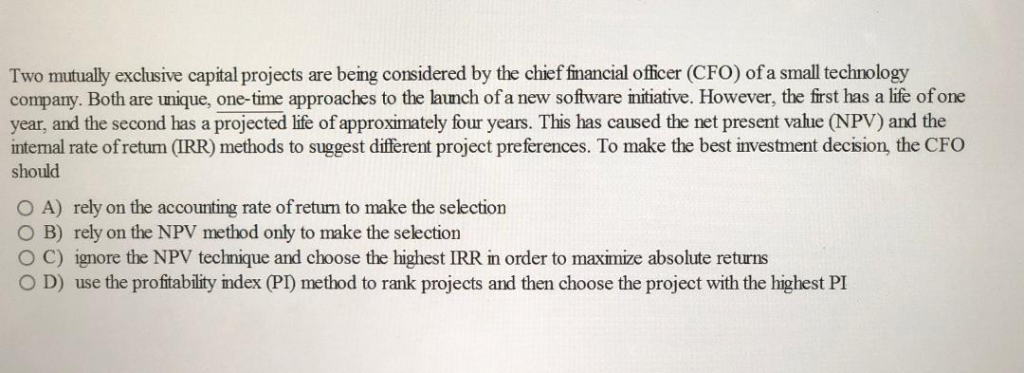

Question: Two mutually exchusive captal projects are being considered by the chief financial officer (CFO) of a small technology company. Both are unique, one-time approaches to

Two mutually exchusive captal projects are being considered by the chief financial officer (CFO) of a small technology company. Both are unique, one-time approaches to the lanch of a new software inifiative. However, the first has a life ofone year, and the second has a projected life of approximately four years. This has caused the net present value (NPV) and the intemal rate of retun (IRR) methods to suggest different project preferences. To make the best investment decision, the CFO should O A) rely on the accounting rate of return to make the selection O B) rely on the NPV method only to make the selection O C) ignore the NPV techmique and choose the highest IRR in order to maximize absolute returns O D) use the profitablity index (PI) method to rank projects and then choose the project with the highest PI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts