Question: Two mutually exclusive alternatives are being considered. Both have lives of 10 years. Alternative A has a first cost of $10,000 and annual benefits of

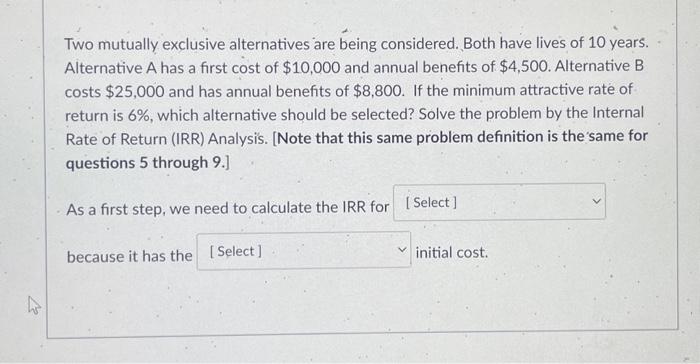

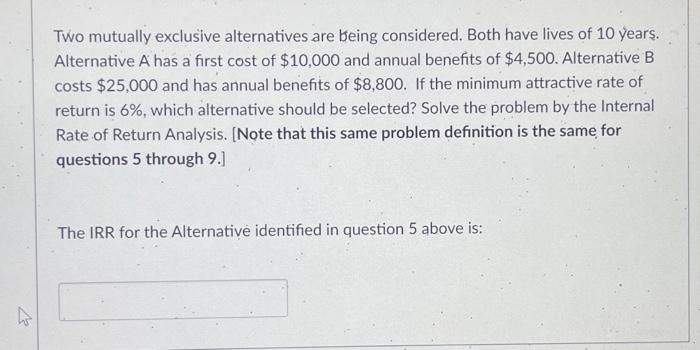

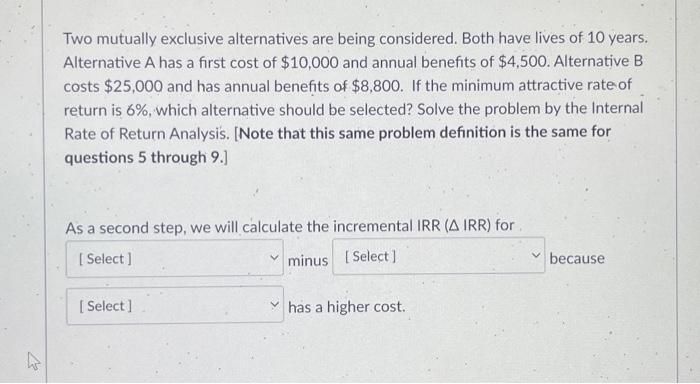

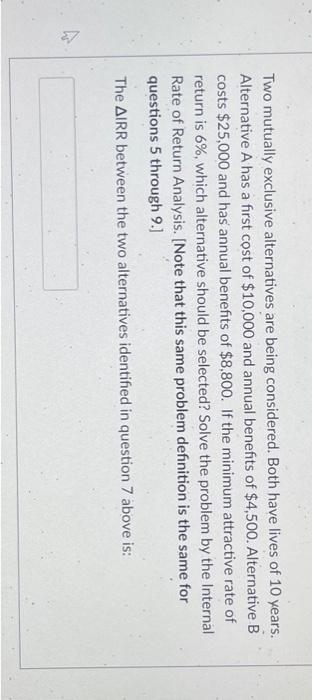

Two mutually exclusive alternatives are being considered. Both have lives of 10 years. Alternative A has a first cost of $10,000 and annual benefits of $4,500. Alternative B costs $25,000 and has annual benefits of $8,800. If the minimum attractive rate of return is 6%, which alternative should be selected? Solve the problem by the Internal Rate of Return Analysis. [Note that this same problem definition is the same for questions 5 through 9.] As a second step, we will calculate the incremental IRR ( IRR) for minus because has a higher cost. Two mutually exclusive alternatives are being considered. Both have lives of 10 years. Alternative A has a first cost of $10,000 and annual benefits of $4,500. Alternative B costs $25,000 and has annual benefits of $8,800. If the minimum attractive rate of return is 6%, which alternative should be selected? Solve the problem by the Internal Rate of Return (IRR) Analysis. [Note that this same problem definition is the same for questions 5 through 9.] As a first step, we need to calculate the IRR for because it has the initial cost. Two mutually exclusive alternatives are being considered. Both have lives of 10 years. Alternative A has a first cost of $10,000 and annual benefits of $4,500. Alternative B costs $25,000 and has annual benefits of $8,800. If the minimum attractive rate of return is 6%, which alternative should be selected? Solve the problem by the Internal Rate of Return Analysis. [Note that this same problem definition is the same for questions 5 through 9.] Considering the obtained IRR (provided in question 8 above), the preferred alternative is Two mutually exclusive alternatives are being considered. Both have lives of 10 years. Alternative A has a first cost of $10,000 and annual benefits of $4,500. Alternative B costs $25,000 and has annual benefits of $8,800. If the minimum attractive rate of return is 6%, which alternative should be selected? Solve the problem by the Internal Rate of Return Analysis. [Note that this same problem definition is the same for questions 5 through 9.] The IRR for the Alternative identified in question 5 above is: Two mutually exclusive alternatives are being considered. Both have lives of 10 years. Alternative A has a first cost of $10,000 and annual benefits of $4,500. Alternative B costs $25,000 and has annual benefits of $8,800. If the minimum attractive rate of return is 6%, which alternative should be selected? Solve the problem by the Internal Rate of Return Analysis. [Note that this same problem definition is the same for questions 5 through 9.] The IRR between the two alternatives identified in question 7 above is: Two mutually exclusive alternatives are being considered. Both have lives of 10 years. Alternative A has a first cost of $10,000 and annual benefits of $4,500. Alternative B costs $25,000 and has annual benefits of $8,800. If the minimum attractive rate of return is 6%, which alternative should be selected? Solve the problem by the Internal Rate of Return Analysis. [Note that this same problem definition is the same for questions 5 through 9.] As a second step, we will calculate the incremental IRR ( IRR) for minus because has a higher cost. Two mutually exclusive alternatives are being considered. Both have lives of 10 years. Alternative A has a first cost of $10,000 and annual benefits of $4,500. Alternative B costs $25,000 and has annual benefits of $8,800. If the minimum attractive rate of return is 6%, which alternative should be selected? Solve the problem by the Internal Rate of Return (IRR) Analysis. [Note that this same problem definition is the same for questions 5 through 9.] As a first step, we need to calculate the IRR for because it has the initial cost. Two mutually exclusive alternatives are being considered. Both have lives of 10 years. Alternative A has a first cost of $10,000 and annual benefits of $4,500. Alternative B costs $25,000 and has annual benefits of $8,800. If the minimum attractive rate of return is 6%, which alternative should be selected? Solve the problem by the Internal Rate of Return Analysis. [Note that this same problem definition is the same for questions 5 through 9.] Considering the obtained IRR (provided in question 8 above), the preferred alternative is Two mutually exclusive alternatives are being considered. Both have lives of 10 years. Alternative A has a first cost of $10,000 and annual benefits of $4,500. Alternative B costs $25,000 and has annual benefits of $8,800. If the minimum attractive rate of return is 6%, which alternative should be selected? Solve the problem by the Internal Rate of Return Analysis. [Note that this same problem definition is the same for questions 5 through 9.] The IRR for the Alternative identified in question 5 above is: Two mutually exclusive alternatives are being considered. Both have lives of 10 years. Alternative A has a first cost of $10,000 and annual benefits of $4,500. Alternative B costs $25,000 and has annual benefits of $8,800. If the minimum attractive rate of return is 6%, which alternative should be selected? Solve the problem by the Internal Rate of Return Analysis. [Note that this same problem definition is the same for questions 5 through 9.] The IRR between the two alternatives identified in question 7 above is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts