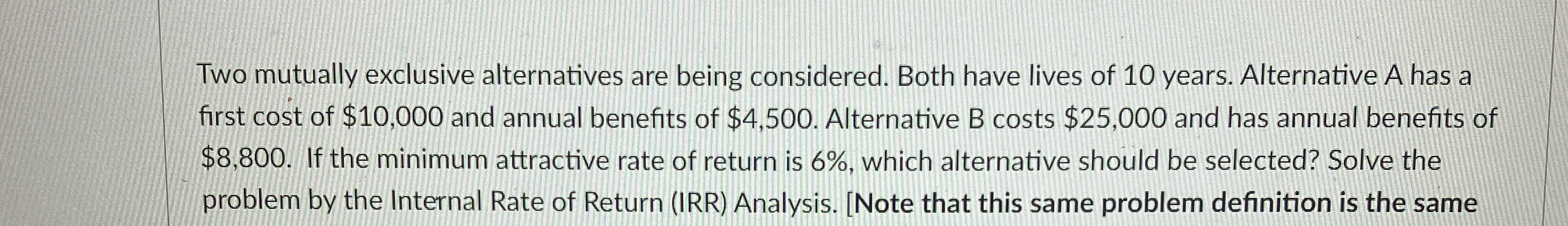

Question: Two mutually exclusive alternatives are being considered. Both have lives of 1 0 years. Alternative A has a first cost of $ 1 0 ,

Two mutually exclusive alternatives are being considered. Both have lives of years. Alternative A has a first cost of $ and annual benefits of $ Alternative B costs $ and has annual benefits of $ If the minimum attractive rate of return is which alternative should be selected? Solve the problem by the Internal Rate of Return IRR Analysis. Note that this same problem definition is the same for questions through

As a first step, we need to calculate the IRR for because it has the

initial cost.

Th

Two mutually exclusive alternatives are being considered. Both have lives of years. Alternative A has a first cost of $ and annual benefits of $ Alternative B costs $ and has annual benefits of $ If the minimum attractive rate of return is which alternative should be selected? Solve the problem by the Internal Rate of Return IRR Analysis. Note that this same problem definition is the same

PLEASE ANSWER THIS QUESTION:

AS a first step, we need to calculate the IRR for Alternative A or Alternative B because it has the higher or lower initial cost.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock