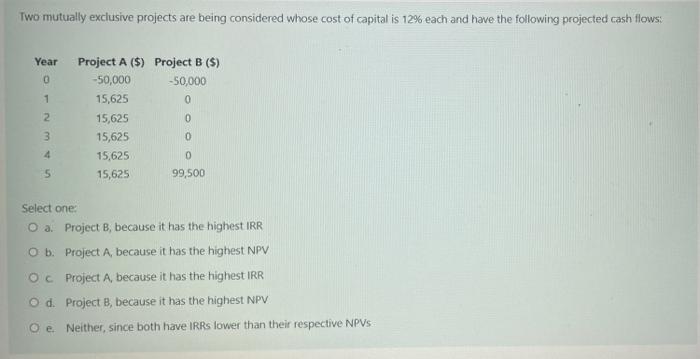

Question: Two mutually exclusive projects are being considered whose cost of capital is 12% each and have the following projected cash flows: Year Project A ($)

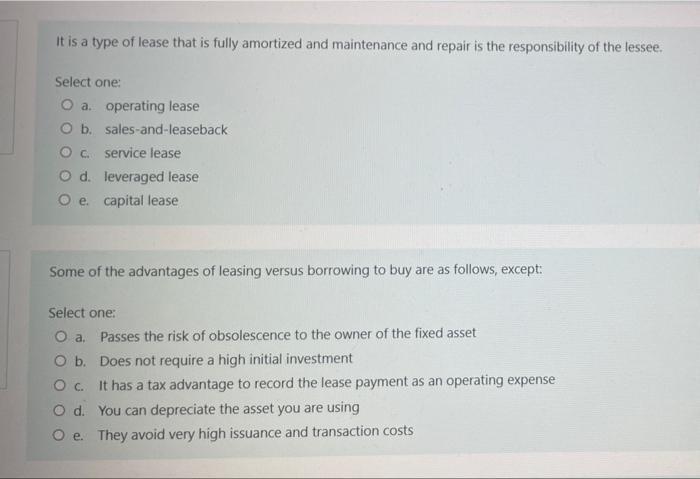

Two mutually exclusive projects are being considered whose cost of capital is 12% each and have the following projected cash flows: Year Project A ($) Project B ($) 0 -50,000 -50,000 1 15,625 0 2 15,625 15,625 4 15,625 0 5 15,625 99,500 Select one: O a. Project B, because it has the highest IRR O b. Project A, because it has the highest NPV Oc Project A, because it has the highest IRR O d. Project B, because it has the highest NPV Oe. Neither, since both have IRRS lower than their respective NPVs 3 0 0 It is a type of lease that is fully amortized and maintenance and repair is the responsibility of the lessee. Select one: O a. operating lease O b. O c. service lease O d. leveraged lease O e. capital lease Some of the advantages of leasing versus borrowing to buy are as follows, except: Select one: O a. Passes the risk of obsolescence to the owner of the fixed asset O b. Does not require a high initial investment O c. It has a tax advantage to record the lease payment as an operating expense O d. You can depreciate the asset you are using Oe. They avoid very high issuance and transaction costs sales-and-leaseback

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts