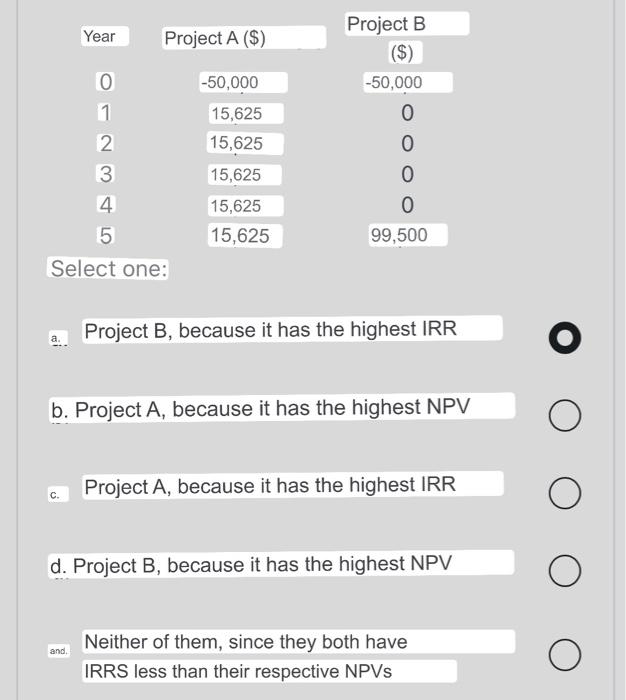

Question: Two mutually exclusive projects are being considered whose cost of capital is 12% each and have the following projected cash flows: Project B Year Project

Project B Year Project A ($) ($) 0 -50,000 -50,000 1 15,625 0 2 15,625 0 3 15,625 0 4 15,625 0 5 15,625 99,500 Select one: Project B, because it has the highest IRR b. Project A, because it has the highest NPV Project A, because it has the highest IRR C. d. Project B, because it has the highest NPV and. Neither of them, since they both have IRRS less than their respective NPVs O O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts