Question: TWO PART QUESTION Part 2 -- The Optimal Portfolio -- a. is the combination of assets along the Efficent Frontier expected to deliver the highest

TWO PART QUESTION

Part 2 -- The Optimal Portfolio --

a. is the combination of assets along the Efficent Frontier expected to deliver the highest returns for the lowest risk

b. is the combination of assets which all or at least most clients should generally be guided into by financial advisors

c. once applied to client accounts will typically generate returns not available to individuals managing their own money

d. is the combination of assets along the Efficent Frontier expected to deliver the lowest risk

e. produces an asset allocation which typically produces returns which more than pays for the 1-2% fees professionals may charge for assets under management

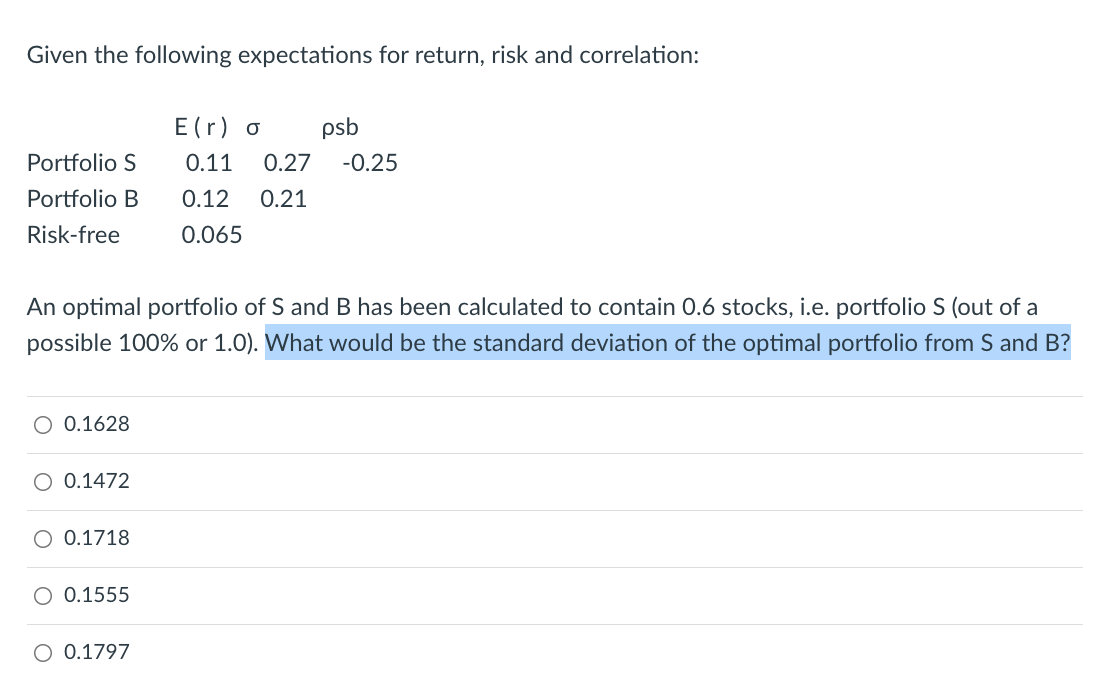

Given the following expectations for return, risk and correlation: E (r) o psb Portfolio S 0.11 0.27 -0.25 Portfolio B 0.12 0.21 Risk-free 0.065 An optimal portfolio of S and B has been calculated to contain 0.6 stocks, i.e. portfolio S (out of a possible 100% or 1.0). What would be the standard deviation of the optimal portfolio from S and B? O 0.1628 O 0.1472 O 0.1718 O 0.1555 O 0.1797

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts