Question: Two plans are under consideration to provide certain facilavies for a public uniling ach oun is designed to provide enough capacity during the next 18

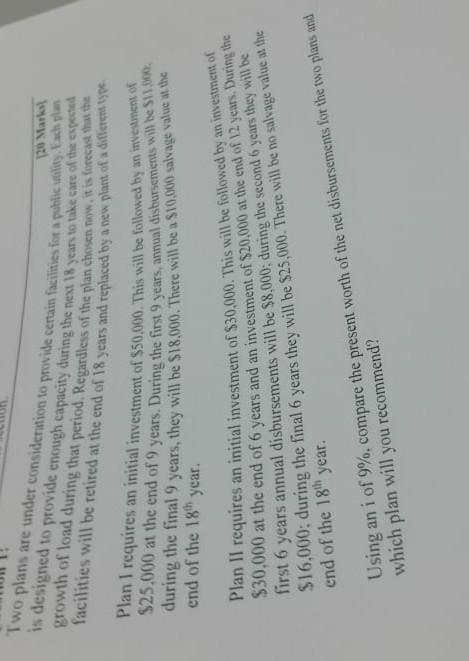

Two plans are under consideration to provide certain facilavies for a public uniling ach oun is designed to provide enough capacity during the next 18 years to take care o growth of load during that period. Regardless of the plan chosem mefifts syp 20 Marks facilities will be retired at the end of 18 years and replaced by a new p the espected Plan I requires an initial investment of $50,000. This will be followed by an i $25,000 at the end of 9 years. During the first 9 years, annual during the final 9 years, they will be $18,000. There will be a $10,000 salvage value at end of the 18th year. disbursements will Plan II requires an initial investment of $30,000. This will be followed by an investment of $30,000 fi rst 6 years annual disbursements will be $8,000, during the second 6 years they will be S16,000: during the final 6 years they will be $25,000. There will be no salvage value at the end of the 18h year. at the end of 6 years and an investment of $20,000 at the end of 12 years. During the Using an i of 990, compare the prese which plan will you recommend? nt worth of the net disbursements for the two plans and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts