Question: Two process modifications are being considered. The initial costs and savings are shown below. The savings below depends on future sales volumes and product lifetimes.

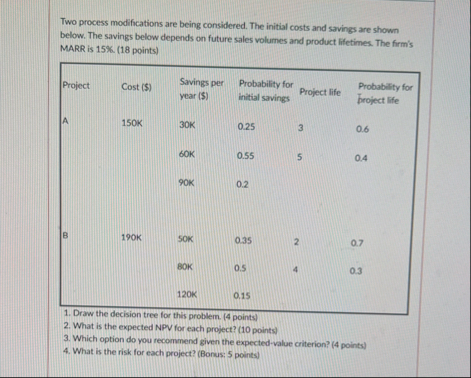

Two process modifications are being considered. The initial costs and savings are shown below. The savings below depends on future sales volumes and product lifetimes. The firm's MARR is points

tableProjectCost $Savings per year $Probability for initial savings,Project life,Probability for broject lifeAKKKKBKKKK

Draw the decision tree for this problem. points

What is the expected NPV for each project? points

Which option do you recommend given the expectedvalue criterion? points

What is the risk for each project? Bonus: points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock