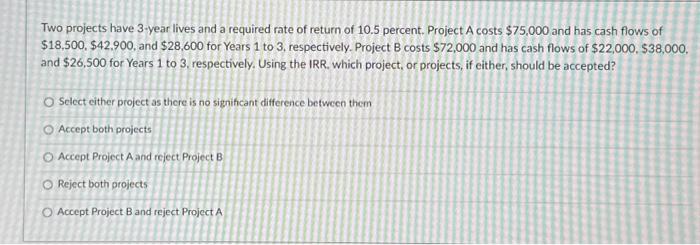

Question: Two projects have 3 -year lives and a required rate of return of 10.5 percent. Project A costs $75,000 and has cash flows of $18,500,$42,900,

Two projects have 3 -year lives and a required rate of return of 10.5 percent. Project A costs $75,000 and has cash flows of $18,500,$42,900, and $28,600 for Years 1 to 3 , respectively. Project B costs $72,000 and has cash flows of $22,000,$38,000, and $26,500 for Years 1 to 3 , respectively. Using the IRR. which project, or projects, if either, should be accepted? Select either project as there is no significant difference befween them Accept both projects Accept Project A and reject Project B Reject both projects Accept Project B and reject Project A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts