Question: Two publicly-traded U.S. companies for this project will be Amazon & Google.1 The two companies must prepare the financial statements denominated in U.S Dollar in

Two publicly-traded U.S. companies for this project will be Amazon & Google.1

The two companies must prepare the financial statements denominated in U.S Dollar in accordance with U.S. GAAP and have non-zero, identifiable amounts of accounts receivable, inventory, cost of goods sold, operating income, and interest expense in the most recent annual reports.

The annual reports must be for a fiscal year beginning no earlier than June 1, 2020.

Perform the following:

1. Provide a brief (1-3 sentences) summary of the business of each company and a brief (one paragraph at most) description of the similarities and differences in the businesses of the two companies.

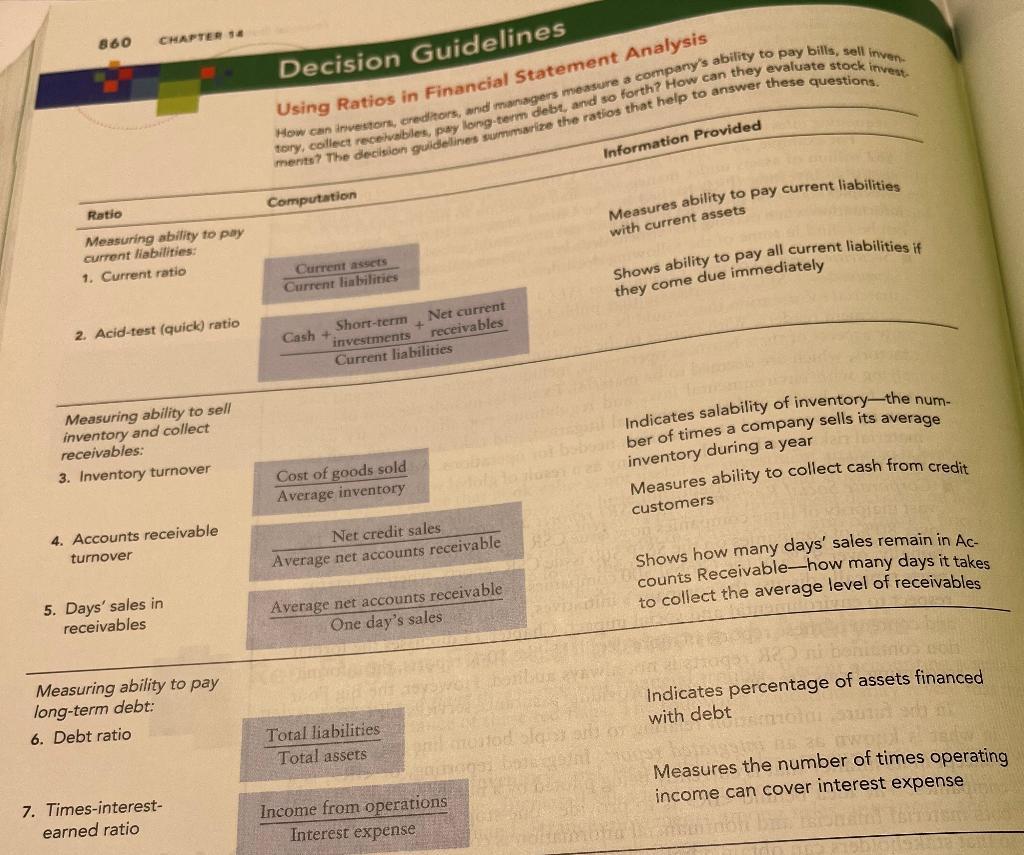

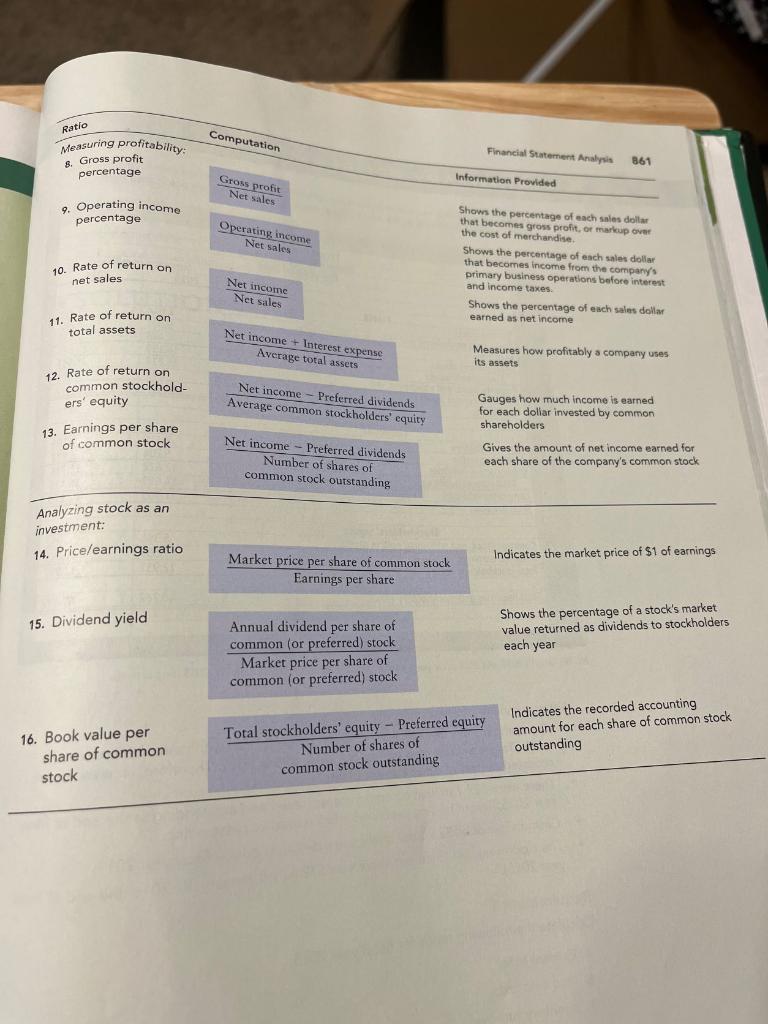

2. For each company, tabulate the 16 ratios indicated on pages 860-861 in the textbook using the financial results for the most recent fiscal year. Show your computations.

3. Evaluate the relative performance of the two companies using your findings from the vertical, horizontal (including an analysis of trend in various income measures over a period of a minimum of 3 years), and ratio analyses.

4. Report which of the two companies you would pick if you are to invest $100,000 cash on the stock of one of the two companies and hold the investment for a year or longer. Justify your choice.

860 Ratio CHAPTER 14 Measuring ability to pay current liabilities: 1. Current ratio 2. Acid-test (quick) ratio Measuring ability to sell inventory and collect receivables: 3. Inventory turnover 4. Accounts receivable turnover 5. Days' sales in receivables Measuring ability to pay long-term debt: 6. Debt ratio 7. Times-interest- earned ratio Decision Guidelines Using Ratios in Financial Statement Analysis How can investors, creditors, and managers measure a company's ability to pay bills, sell inven tory, collect receivables, pay long-term debt, and so forth? How can they evaluate stock invest ments? The decision guidelines summarize the ratios that help to answer these questions. Computation Current assets Current liabilities Short-term + investments Current liabilities Cash + Cost of goods sold Average inventory Net current receivables Net credit sales Average net accounts receivable Average net accounts receivable One day's sales Total liabilities Total assets pail mostod 2016092 Income from operations Interest expense Information Provided Measures ability to pay current liabilities with current assets Shows ability to pay all current liabilities if they come due immediately Indicates salability of inventory-the num- anber of times a company sells its average inventory during a year Measures ability to collect cash from credit customers Shows how many days' sales remain in Ac- counts Receivable-how many days it takes to collect the average level of receivables Indicates percentage of assets financed er ass with debt 16001 los as awood Measures the number of times operating income can cover interest expense

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

The provided information outlines various financial ratios used in financial statement analysis Here are the ratios described along with their respective computations 1 Current ratio Current assets Cu... View full answer

Get step-by-step solutions from verified subject matter experts