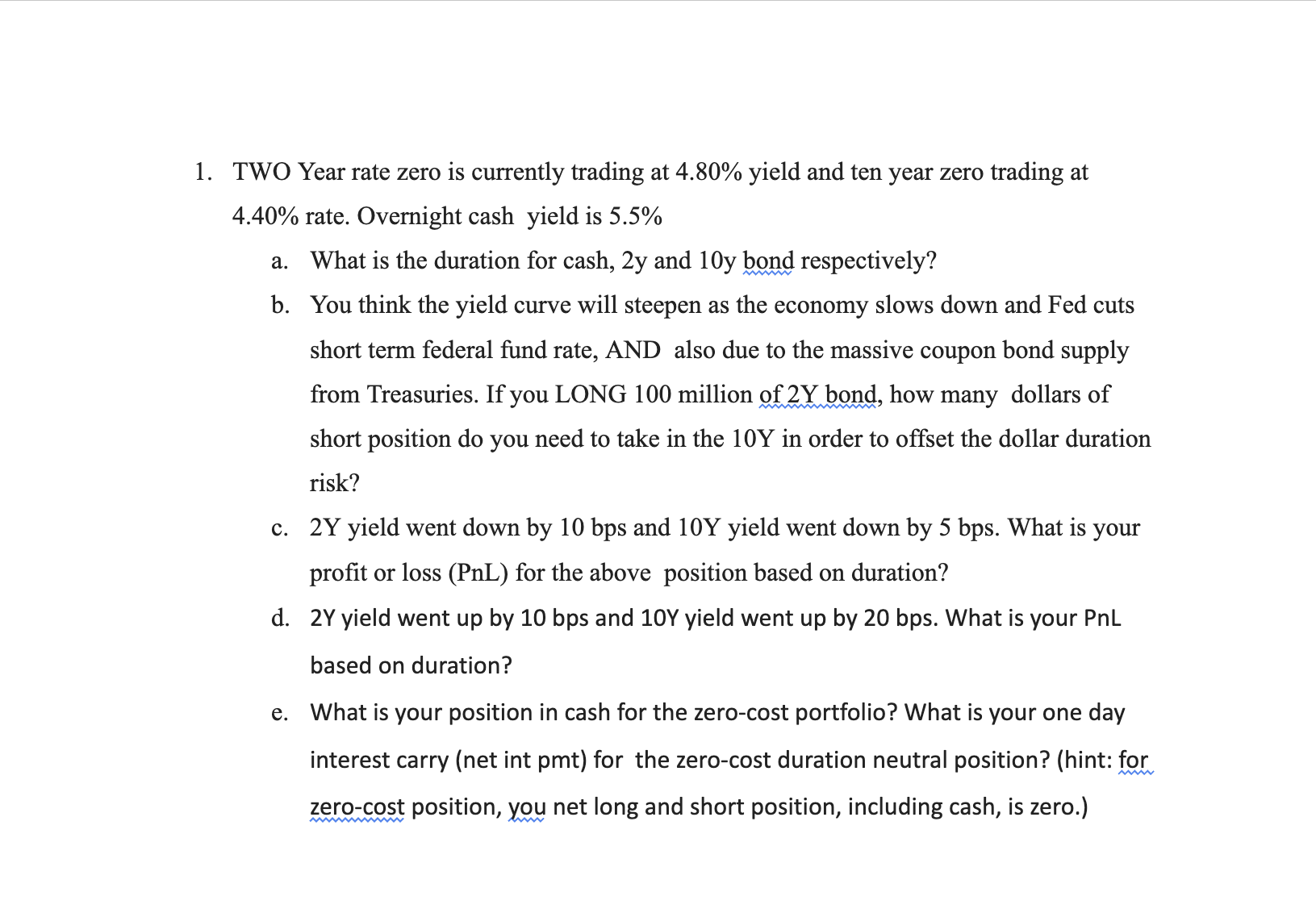

Question: TWO Year rate zero is currently trading at 4 . 8 0 % yield and ten year zero trading at 4 . 4 0 %

TWO Year rate zero is currently trading at yield and ten year zero trading at

rate. Overnight cash yield is

a What is the duration for cash, year and year bond respectively?

b You think the yield curve will steepen as the economy slows down and Fed cuts

short term federal fund rate, AND also due to the massive coupon bond supply

from Treasuries. If you LONG million of year bond, how many dollars of

short position do you need to take in the year in order to offset the dollar duration

risk?

c year yield went down by basis points and year yield went down by basis points. What is your profit or loss for the above position based on duration?

d year yield went up by basis pointsand yield went up by basis points. What is your PnL based on duration?

e What is your position in cash for the zerocost portfolio? What is your one day

interest carry net int payment for the zerocost duration neutral position?hint: for zerocost position, you net long and short position, including cash, is zero.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock