Question: Question 1 ( 1 point ) M&MII is an extension of M&M I in that the very restrictive assumptions still apply. However, the M&M II

Question point

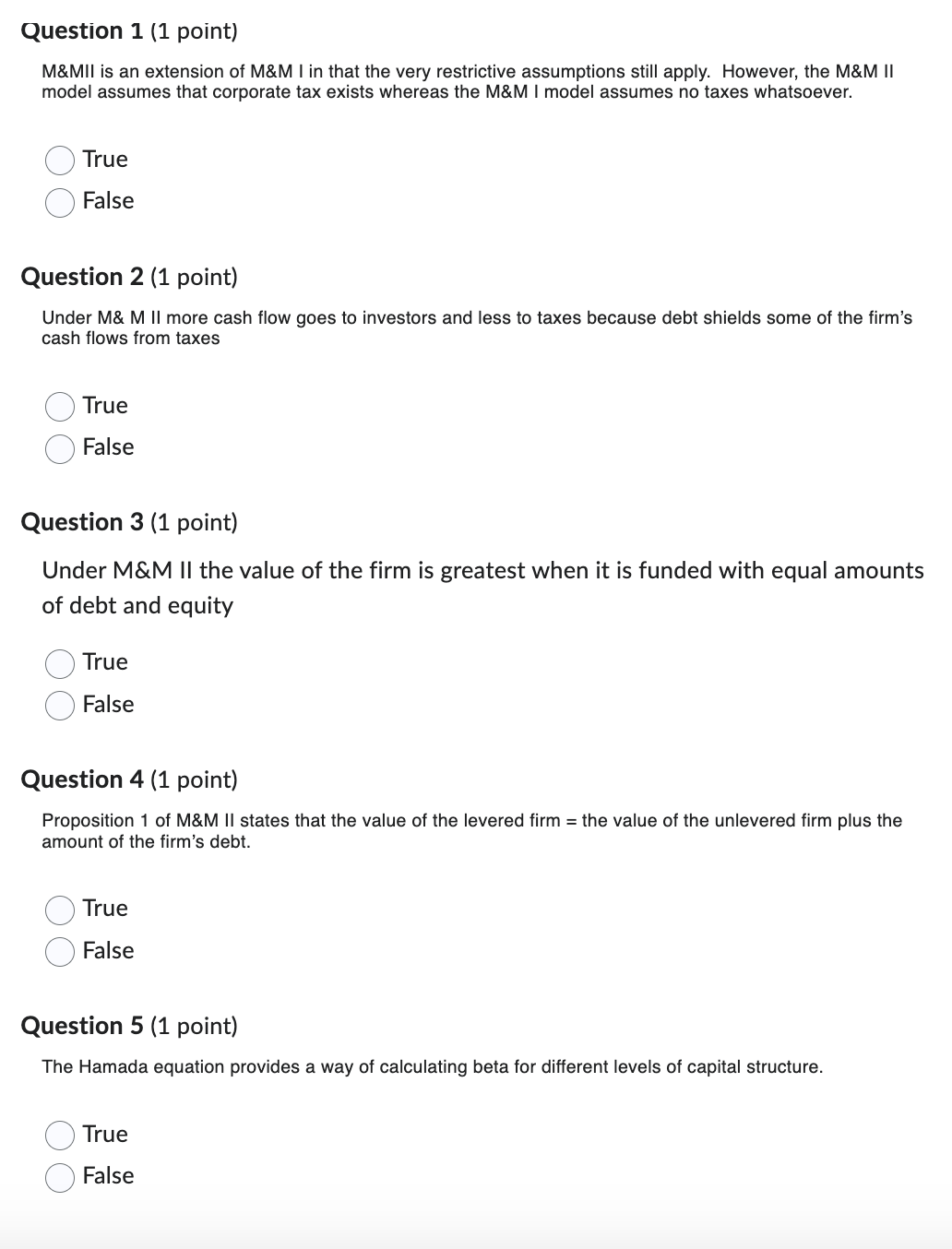

M&MII is an extension of M&M I in that the very restrictive assumptions still apply. However, the M&M II

model assumes that corporate tax exists whereas the M&M I model assumes no taxes whatsoever.

True

False

Question point

Under M& M II more cash flow goes to investors and less to taxes because debt shields some of the firm's

cash flows from taxes

True

False

Question point

Under M&M II the value of the firm is greatest when it is funded with equal amounts

of debt and equity

True

False

Question point

Proposition of M&M II states that the value of the levered firm the value of the unlevered firm plus the

amount of the firm's debt.

True

False

Question point

The Hamada equation provides a way of calculating beta for different levels of capital structure.

True

False

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock