Question: Type or paste question here Assignment #2 Ch. 9 - Buy and Hold: Worksheet to calculate NOI Name: Read the information below and fill in

Type or paste question here

Type or paste question here

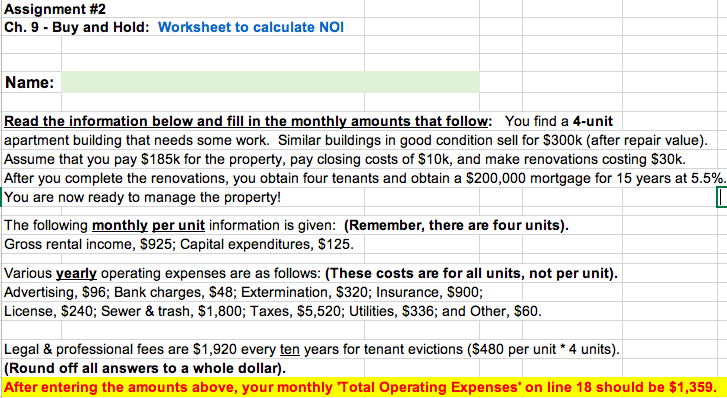

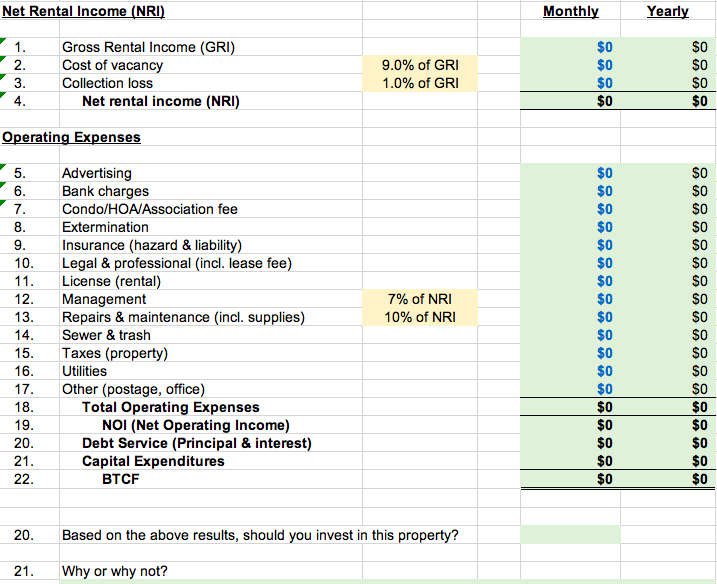

Assignment #2 Ch. 9 - Buy and Hold: Worksheet to calculate NOI Name: Read the information below and fill in the monthly amounts that follow: You find a 4-unit apartment building that needs some work. Similar buildings in good condition sell for $300k (after repair value). Assume that you pay $185k for the property, pay closing costs of $10k, and make renovations costing $30k. After you complete the renovations, you obtain four tenants and obtain a $200,000 mortgage for 15 years at 5.5%. You are now ready to manage the property! The following monthly per unit information is given: (Remember, there are four units). Gross rental income, $925; Capital expenditures, $125. Various yearly operating expenses are as follows: (These costs are for all units, not per unit). Advertising, $96; Bank charges, $48; Extermination, $320; Insurance, $900; License, $240; Sewer & trash, $1,800; Taxes, $5,520; Utilities, $336; and Other, $60. Legal & professional fees are $1,920 every ten years for tenant evictions ($480 per unit * 4 units). (Round off all answers to a whole dollar). After entering the amounts above, your monthly Total Operating Expenses' on line 18 should be $1,359. Net Rental Income (NRI) Monthly Yearly 1. 2. 3. 4. Gross Rental Income (GRI) Cost of vacancy Collection loss Net rental income (NRI) 9.0% of GRI 1.0% of GRI $0 $0 $0 $0 $0 $0 $0 $0 Operating Expenses $0 $0 $0 $0 $0 $0 $0 $0 7% of NRI 10% of NRI 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. Advertising Bank charges Condo/HOA/Association fee Extermination Insurance (hazard & liability) Legal & professional (incl. lease fee) License (rental) Management Repairs & maintenance (incl. supplies) Sewer & trash Taxes (property) Utilities Other (postage, office) Total Operating Expenses NOI (Net Operating Income) Debt Service (Principal & interest) Capital Expenditures BTCF $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $O $0 $0 $O $0 $0 $0 $O $0 $0 $0 $O $0 $0 $0 $0 $0 20. Based on the above results, should you invest in this property? 21. Why or why not? Assignment #2 Ch. 9 - Buy and Hold: Worksheet to calculate NOI Name: Read the information below and fill in the monthly amounts that follow: You find a 4-unit apartment building that needs some work. Similar buildings in good condition sell for $300k (after repair value). Assume that you pay $185k for the property, pay closing costs of $10k, and make renovations costing $30k. After you complete the renovations, you obtain four tenants and obtain a $200,000 mortgage for 15 years at 5.5%. You are now ready to manage the property! The following monthly per unit information is given: (Remember, there are four units). Gross rental income, $925; Capital expenditures, $125. Various yearly operating expenses are as follows: (These costs are for all units, not per unit). Advertising, $96; Bank charges, $48; Extermination, $320; Insurance, $900; License, $240; Sewer & trash, $1,800; Taxes, $5,520; Utilities, $336; and Other, $60. Legal & professional fees are $1,920 every ten years for tenant evictions ($480 per unit * 4 units). (Round off all answers to a whole dollar). After entering the amounts above, your monthly Total Operating Expenses' on line 18 should be $1,359. Net Rental Income (NRI) Monthly Yearly 1. 2. 3. 4. Gross Rental Income (GRI) Cost of vacancy Collection loss Net rental income (NRI) 9.0% of GRI 1.0% of GRI $0 $0 $0 $0 $0 $0 $0 $0 Operating Expenses $0 $0 $0 $0 $0 $0 $0 $0 7% of NRI 10% of NRI 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. Advertising Bank charges Condo/HOA/Association fee Extermination Insurance (hazard & liability) Legal & professional (incl. lease fee) License (rental) Management Repairs & maintenance (incl. supplies) Sewer & trash Taxes (property) Utilities Other (postage, office) Total Operating Expenses NOI (Net Operating Income) Debt Service (Principal & interest) Capital Expenditures BTCF $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $O $0 $0 $O $0 $0 $0 $O $0 $0 $0 $O $0 $0 $0 $0 $0 20. Based on the above results, should you invest in this property? 21. Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts