Question: Type or paste question here F QUESTION THREE Mukubesa Ltd currently runs a centralised billing system. For Payments by cheque, they are made by all

Type or paste question here

Type or paste question here

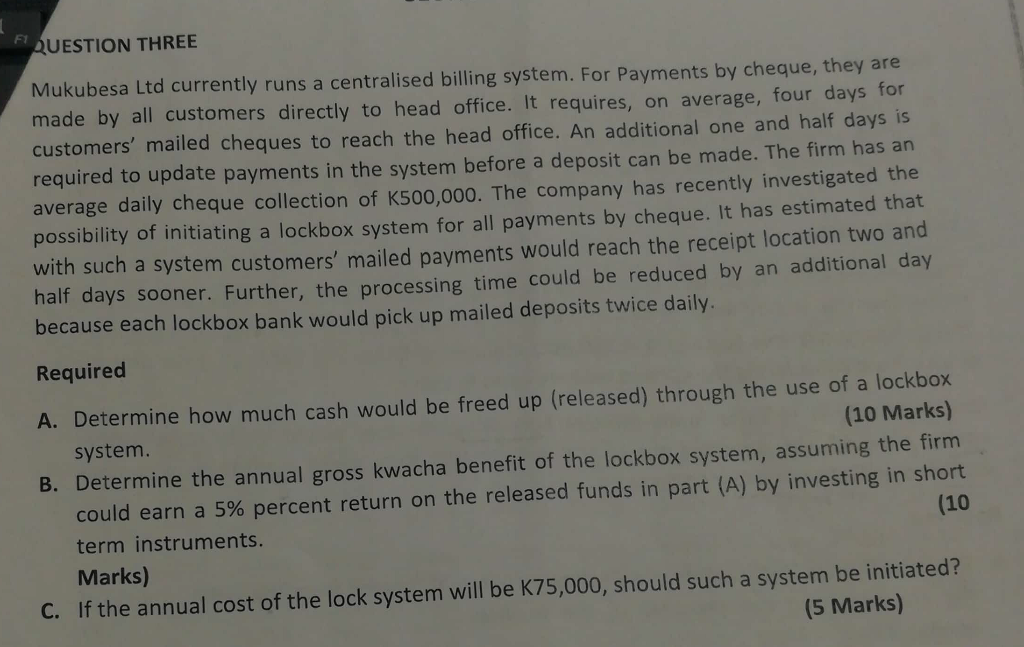

F QUESTION THREE Mukubesa Ltd currently runs a centralised billing system. For Payments by cheque, they are made by all customers directly to head office. It requires, on average, four days for customers' mailed cheques to reach the head office. An additional one and half days is required to update payments in the system before a deposit can be made. The firm has an average daily cheque collection of K500,000. The company has recently investigated the possibility of initiating a lockbox system for all payments by cheque. It has estimated that with such a system customers' mailed payments would reach the receipt location two and half days sooner. Further, the processing time could be reduced by an additional day because each lockbox bank would pick up mailed deposits twice daily. Required A. Determine how much cash would be freed up (released) through the use of a lockbox system. (10 Marks) B. Determine the annual gross kwacha benefit of the lockbox system, assuming the firm could earn a 5% percent return on the released funds in part (A) by investing in short term instruments. (10 Marks) C. If the annual cost of the lock system will be 575,000, should such a system be initiated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts