Question: Type or paste question here Question 13 2.86 pts Which of the following most accurately describes the lessons from the Mexican financial crisis of 1992

Type or paste question here

Type or paste question here

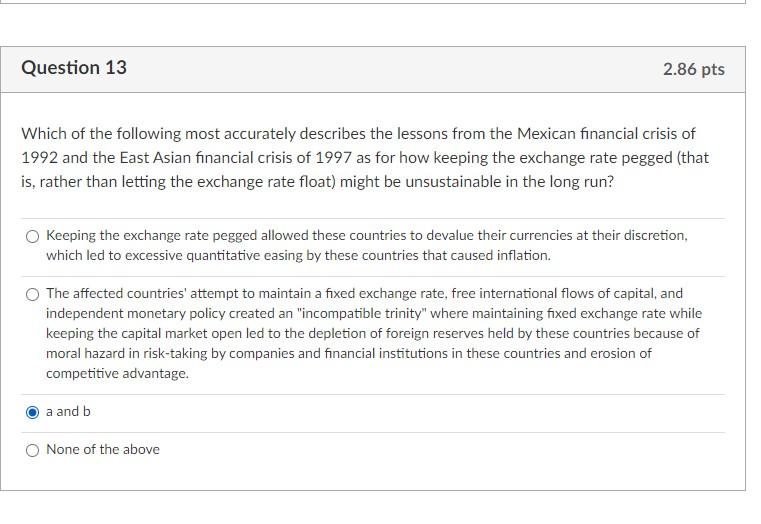

Question 13 2.86 pts Which of the following most accurately describes the lessons from the Mexican financial crisis of 1992 and the East Asian financial crisis of 1997 as for how keeping the exchange rate pegged (that is, rather than letting the exchange rate float) might be unsustainable in the long run? Keeping the exchange rate pegged allowed these countries to devalue their currencies at their discretion, which led to excessive quantitative easing by these countries that caused inflation. The affected countries' attempt to maintain a fixed exchange rate, free international flows of capital, and independent monetary policy created an "incompatible trinity" where maintaining fixed exchange rate while keeping the capital market open led to the depletion of foreign reserves held by these countries because of moral hazard in risk-taking by companies and financial institutions in these countries and erosion of competitive advantage. a and b None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts