Question: tz Incorporated made the following errors when counting inventory on December 31, 2021, December 31, 2022, and December 31, 20 ventory on December 31, 2021

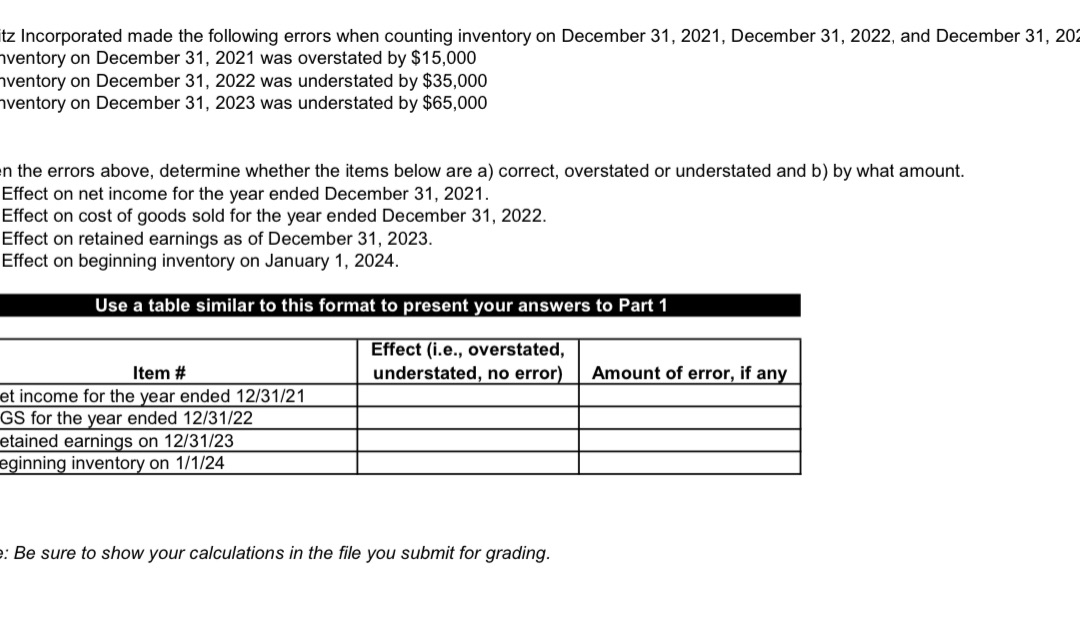

tz Incorporated made the following errors when counting inventory on December 31, 2021, December 31, 2022, and December 31, 20 ventory on December 31, 2021 was overstated by $15,000 ventory on December 31, 2022 was understated by $35,000 ventory on December 31, 2023 was understated by $65,000 n the errors above, determine whether the items below are a) correct, overstated or understated and b) by what amount. Effect on net income for the year ended December 31, 2021. Effect on cost of goods sold for the year ended December 31, 2022. Effect on retained earnings as of December 31, 2023. Effect on beginning inventory on January 1, 2024. Use a table similar to this format to present your answers to Part 1 Effect (i.e., overstated, Item # understated, no error) Amount of error, if any et income for the year ended 12/31/21 GS for the year ended 12/31/22 etained earnings on 12/31/23 eginning inventory on 1/1/24 : Be sure to show your calculations in the file you submit for grading

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts