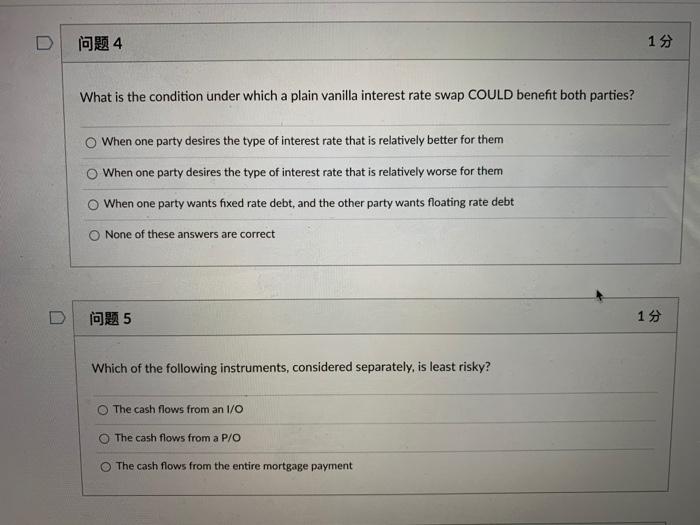

Question: U 4 1 What is the condition under which a plain vanilla interest rate swap COULD benefit both parties? When one party desires the type

U 4 1 What is the condition under which a plain vanilla interest rate swap COULD benefit both parties? When one party desires the type of interest rate that is relatively better for them When one party desires the type of interest rate that is relatively worse for them When one party wants fixed rate debt, and the other party wants floating rate debt None of these answers are correct U 5 19 Which of the following instruments, considered separately, is least risky? The cash flows from an 1/0 The cash flows from a P/O The cash flows from the entire mortgage payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts